Nordstrom 2008 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2008 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 25

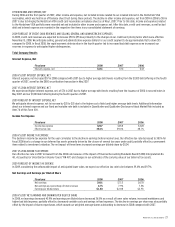

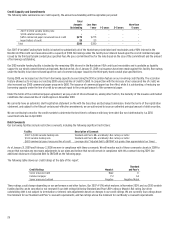

The following table summarizes our store count and square footage activity during 2008:

Store Count Square Footage

Full–line Rack and Full–line Rack and

Total Stores Other Stores Total Stores Other Stores

Balance at February 2, 2008 156 101 55 20.5 18.4 2.1

New store openings & relocations 14 8 6 1.4 1.2 0.2

Store closings (1) — (1) — — —

Balance at January 31, 2009 169 109 60 21.9 19.6 2.3

In 2008 we opened eight full-line stores (Aventura Mall in Aventura, Florida; Ala Moana Center in Honolulu, Hawaii; Burlington Mall in Burlington,

Massachusetts; Partridge Creek in Clinton Township, Michigan; Thousand Oaks in Thousand Oaks, California; Fashion Mall in Indianapolis, Indiana; Ross

Park in Pittsburgh, Pennsylvania; and Waterside in Naples, Florida), relocated one full-line store (Tacoma Mall in Tacoma, Washington), and opened six

Rack stores (City Center in White Plains, New York; Laguna Hills Mall in Laguna Hills, California; Springbrook Prairie Pavilion in Naperville, Illinois; Legacy

Village in Lyndhurst, Ohio; Liberty Tree Mall in Danvers, Massachusetts; and The Rim in San Antonio, Texas). Together these openings increased our

gross square footage by 6.7%.

2009 AND LONG-TERM CAPITAL EXPENDITURES FORECAST

During 2008 we made adjustments to our capital plan as a result of developer delays due to the current economic conditions. With these changes, we

delayed two planned store openings originally planned for 2009. To date in 2009, we have relocated one full-line store and opened two new Rack

stores. During the remainder of 2009, we anticipate opening three new full-line stores and eight additional new Rack stores.

We expect that our capital expenditures (net of property incentives) will be approximately $2,100 over the next five years, with approximately $325

planned for 2009. Over these five years, we plan to use 47% of this investment to build new and relocated stores, 28% on remodels (major and minor),

12% on information technology and 13% for other projects. Our current five-year plans include 28 new stores announced through 2013, which

represents an 11% increase in square footage. Almost half of these stores will be in the Northeast and South. We have also reduced the number of major

full-line store remodels from approximately six per year to approximately two per year. We believe that we have the capacity to address additional

capital investments should opportunities arise.

As of January 31, 2009, we were contractually committed to spend $54 for constructing new stores, remodeling existing stores, and other

capital projects.

Financing Activities

Our net cash used in financing activities was $342 in 2008 compared with $64 provided by financing activities in 2007. In 2008, our financing activities

consisted of $250 in principal paid related to our 5.625% senior notes, dividend payments of $138, and share repurchases of $264, partially offset by $275 of

proceeds from commercial paper issuances.

2008 SHORT AND LONG-TERM BORROWING ACTIVITY

During 2008, we issued $150 in notes using our 2007-A Variable Funding Note (“VFN”) facility, which were repaid in full as of January 31, 2009. We also

issued commercial paper, ending the year with outstanding borrowings of $275. The majority of the outstanding commercial paper as of year-end was

used to repay our $250 senior notes, which we retired in January 2009.

DIVIDENDS

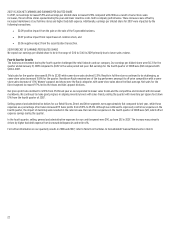

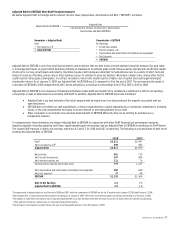

Fiscal year 2008 2007 2006

Cash dividends paid per share $0.64 $0.54 $0.42

In 2008, we paid dividends of $0.64 per share, the twelfth consecutive year that our annual dividends increased. In determining the amount of dividends to

pay, we analyze our dividend payout ratio and dividend yield, and balance the dividend payment with our operating performance and capital resources. For

the dividend yield, which is calculated as our dividends per share divided by our stock price, we plan to target a 1.0% to 1.5% long-term yield. We will

balance any potential future dividend changes with our operating performance and available capital resources.

In February 2009, we declared a first quarter dividend of $0.16 per share, which is consistent with 2008.

2008 SHARE REPURCHASES

Our reported results for 2008 include $264 in share repurchases. During 2008 we repurchased 6.9 shares of our common stock for an aggregate

purchase price of $238, at an average price per share of $34.29. In addition, our results for the period include the settlement of $26 in repurchases

initiated in the fourth quarter of 2007. In August 2007 our Board of Directors authorized a $1,500 share repurchase program and in November 2007

authorized an additional $1,000 for share repurchases, bringing the total program to $2,500. Although the program will not expire until August 2009, we

suspended our share repurchase program in September 2008. We may resume the program in the future if economic conditions improve. As of

January 31, 2009, we had $1,126 in remaining capacity under our share repurchase program. The actual amount and timing of future share repurchases

will be subject to market conditions and applicable Securities and Exchange Commission rules.