Nordstrom 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share and per option amounts

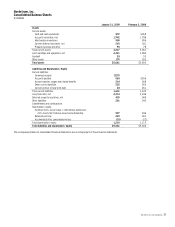

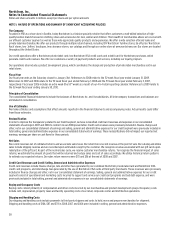

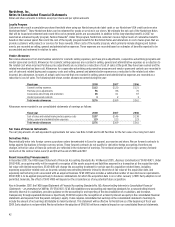

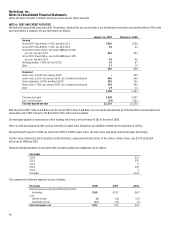

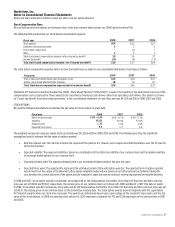

NOTE 3: LAND, BUILDINGS AND EQUIPMENT

Land, buildings and equipment consist of the following:

January 31, 2009 February 2, 2008

Land and land improvements $67 $65

Buildings and building improvements 847 842

Leasehold improvements 1,631 1,313

Store fixtures and equipment 2,214 1,995

Software 347 303

Construction in progress 222 391

5,328 4,909

Less: accumulated depreciation and amortization (3,107) (2,926)

Land, buildings and equipment, net $2,221 $1,983

The total cost of buildings and equipment held under capital lease obligations was $28 at the end of both 2008 and 2007, with related accumulated

amortization of $21 in 2008 and $20 in 2007. The amortization of capitalized leased buildings and equipment of $1 in both 2008 and 2007 was

recorded in depreciation expense.

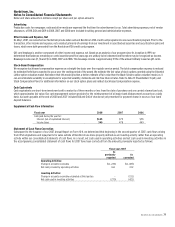

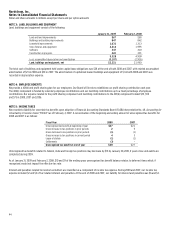

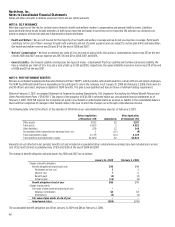

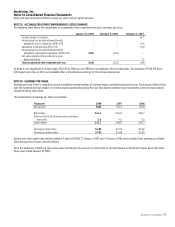

NOTE 4: EMPLOYEE BENEFITS

We provide a 401(k) and profit sharing plan for our employees. Our Board of Directors establishes our profit sharing contribution each year.

The 401(k) component is funded by voluntary employee contributions and our matching contributions up to a fixed percentage of employee

contributions. Our expense related to the profit sharing component and matching contributions to the 401(k) component totaled $39, $50

and $73 in 2008, 2007 and 2006.

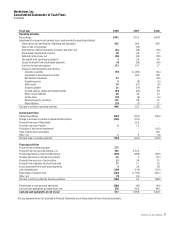

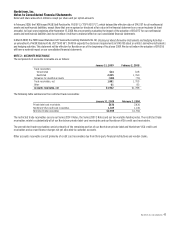

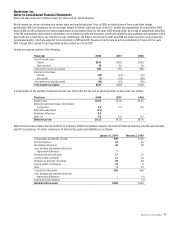

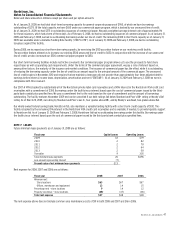

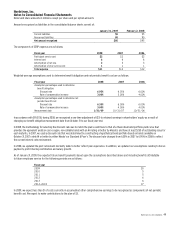

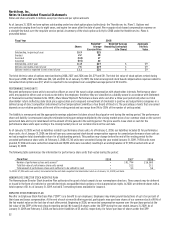

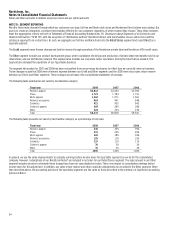

NOTE 5: INCOME TAXES

We recorded a liability for uncertain tax benefits upon adoption of Financial Accounting Standards Board (FASB) Interpretation No. 48,

Accounting for

Uncertainty in Income Taxes

(“FIN 48”) as of February 4, 2007. A reconciliation of the beginning and ending amount of unrecognized tax benefits for

2008 and 2007 is as follows:

Fiscal Year 2008 2007

Unrecognized tax benefit at beginning of year $27 $21

Gross increase to tax positions in prior periods 2 5

Gross decrease to tax positions in prior periods (1) (1)

Gross increase to tax positions in current period 4 3

Lapse of statute (1) (1)

Settlements (3) -

Unrecognized tax benefit at end of year $28 $27

Unrecognized tax benefits related to federal, state and foreign tax positions may decrease by $13 by January 30, 2010, if years close and audits are

completed during 2009.

As of January 31, 2009 and February 2, 2008, $10 and $9 of the ending gross unrecognized tax benefit balance relates to deferred items which, if

recognized, would not impact the effective tax rate.

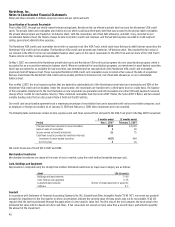

Interest and penalties related to income tax matters are classified as a component of income tax expense. During 2008 and 2007, our income tax

expense included $2 and $3 of tax-related interest and penalties. At the end of 2008 and 2007, our liability for interest and penalties was $6 and $4.