Nordstrom 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share and per option amounts

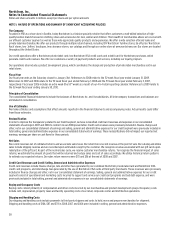

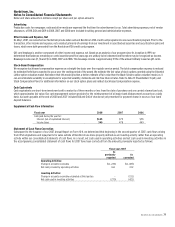

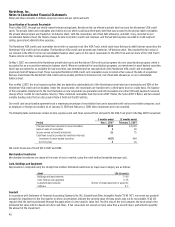

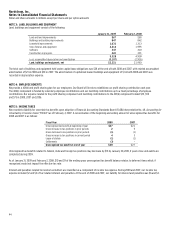

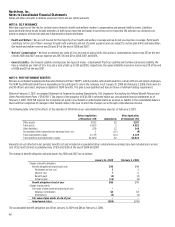

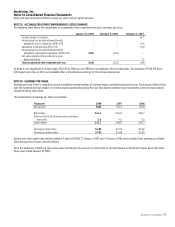

NOTE 6: DEBT AND CREDIT FACILITIES

We hold both secured and unsecured debt. The primary collateral for our secured debt is our Nordstrom private label card and Nordstrom VISA credit

card receivables. A summary of long-term debt is as follows:

January 31, 2009 February 2, 2008

Secured

Series 2007-1 Class A Notes, 4.92%, due April 2010 $326 $326

Series 2007-1 Class B Notes, 5.02%, due April 2010 24 24

Series 2007-2 Class A Notes, one-month LIBOR plus 0.06%

per year, due April 2012 454 454

Series 2007-2 Class B Notes, one-month LIBOR plus 0.18%

per year, due April 2012 46 46

Mortgage payable, 7.68%, due April 2020 63 67

Other 17 19

930 936

Unsecured

Senior notes, 5.625%, due January 2009 – 250

Senior notes, 6.25%, due January 2018, net of unamortized discount 646 646

Senior debentures, 6.95%, due March 2028 300 300

Senior notes, 7.00%, due January 2038, net of unamortized discount 343 342

Other 19 23

1,308 1,561

Total long-term debt 2,238 2,497

Less: current portion (24) (261)

Total due beyond one year $2,214 $2,236

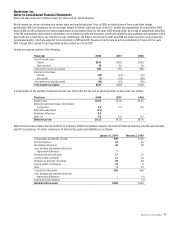

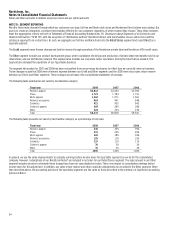

Both the Series 2007-1 Class A & B Notes and the Series 2007-2 Class A & B Notes are secured by substantially all of the Nordstrom private label card

receivables and a 90% interest in the Nordstrom VISA credit card receivables.

Our mortgage payable is secured by an office building which had a net book value of $82 at the end of 2008.

Other secured and unsecured debt consists primarily of capital lease obligations and liabilities related to the acquisition of Jeffrey.

During the fourth quarter of 2008, we retired our $250 in 5.625% senior notes. The notes were paid using commercial paper borrowings.

The fair value of long-term debt, including current maturities, using quoted market prices of the same or similar issues, was $1,750 and $2,514

at the end of 2008 and 2007.

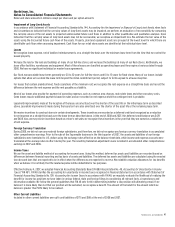

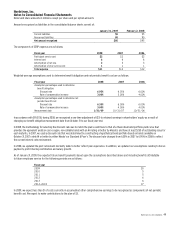

Required principal payments on long-term debt, excluding capital lease obligations, are as follows:

Fiscal year

2009 $23

2010 355

2011 5

2012 505

2013 5

Thereafter 1,332

The components of interest expense, net are as follows:

Fiscal year 2008 2007 2006

Interest expense on long-term debt and short-term

borrowings $145 $102 $63

Less:

Interest income (3) (16) (15)

Capitalized interest (11) (12) (5)

Interest expense, net $131 $74 $43