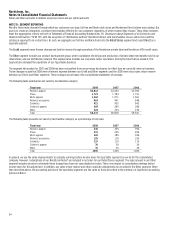

Nordstrom 2008 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2008 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 45

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share and per option amounts

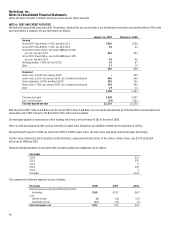

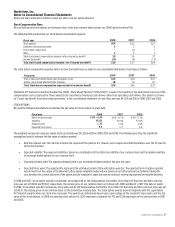

We file income tax returns in federal and various state and local jurisdictions. Prior to 2008, we filed returns in France and other foreign

jurisdictions. With few exceptions, we are no longer subject to federal, state and local, or non-U.S. income tax examinations for years before 2002.

During 2008, the IRS completed its routine examinations of our federal filings for the years 2002 through 2006. As a result of adjustments identified

in the IRS examinations and revisions of estimates, we increased our deferred tax assets, specifically related to land, buildings and equipment which

also resulted in a reduction in our effective tax rate. Additionally, the federal tax returns for 2007 and 2008 are under concurrent year processing

(accelerated audits), which are expected to be completed in 2009 and 2010. We also currently have an active examination in France for the years

2001 through 2004, related to our Façonnable business which we sold in 2007.

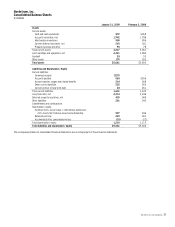

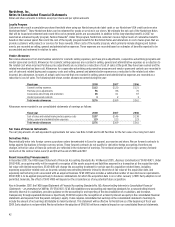

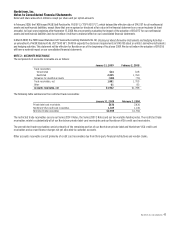

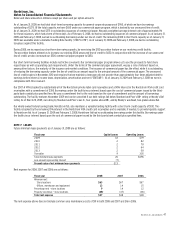

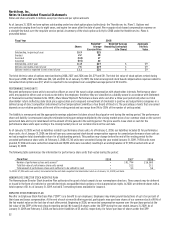

Income tax expense consists of the following:

Fiscal year 2008 2007 2006

Current income taxes:

Federal $244 $435 $423

State and local 39 65 63

Total current income tax expense 283 500 486

Deferred income taxes:

Current (29) (24) (10)

Non-current (7) (18) (48)

Total deferred income tax benefit (36) (42) (58)

Total income tax expense $247 $458 $428

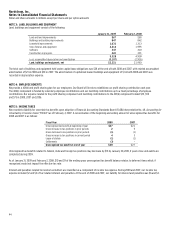

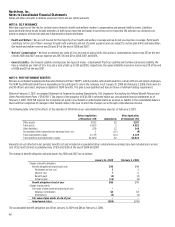

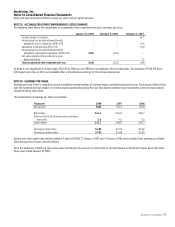

A reconciliation of the statutory Federal income tax rate to the effective tax rate on earnings before income taxes is as follows:

Fiscal year 2008 2007 2006

Statutory rate 35.0% 35.0% 35.0%

State and local income taxes, net of federal

income taxes 3.4 3.4 3.2

Deferred tax adjustment (3.2) - -

Permanent differences 2.0 - -

Other, net 0.9 0.6 0.5

Effective tax rate 38.1% 39.0% 38.7%

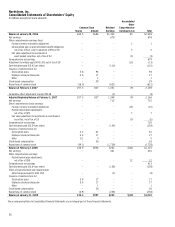

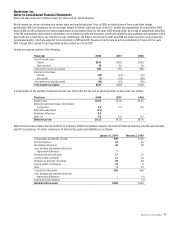

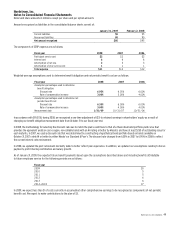

Deferred income taxes reflect the net tax effect of temporary differences between amounts recorded for financial reporting purposes and amounts

used for tax purposes. The major components of deferred tax assets and liabilities are as follows:

January 31, 2009 February 2, 2008

Compensation and benefits accruals $99 $105

Accrued expenses 63 56

Merchandise inventories 26 28

Land, buildings and equipment basis and

depreciation differences 7 -

Gift cards and gift certificates 17 15

Loyalty reward certificates 11 10

Allowance on accounts receivables 54 28

Federal benefit of state taxes 10 9

Other 2 13

Total deferred tax assets 289 264

Land, buildings and equipment basis and

depreciation differences – (4)

Total deferred tax liabilities – (4)

Net deferred tax assets $289 $260