Nordstrom 2008 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2008 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

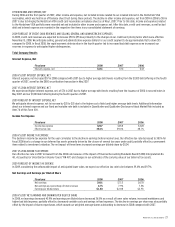

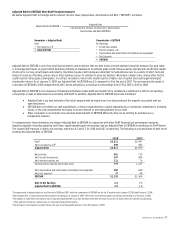

Credit Capacity and Commitments

The following table summarizes our credit capacity, the amounts outstanding and the expiration per period:

Total

Amounts

Outstanding

Less than

1 year

1–3 years 3–5 years

More than

5 years

2007–A $300 variable funding note - — — — —

$100 variable funding note - - — — —

$650 commercial paper/unsecured line of credit $275 $275 — — —

Import letters of credit $5 $5 — — —

Total $280 $280 — — —

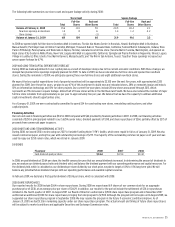

Our 2007-A Variable Funding Note facility is backed by substantially all of the Nordstrom private label card receivables and a 90% interest in the

Nordstrom VISA credit card receivables with a capacity of $300. Borrowings under the facility incur interest based upon the cost of commercial paper

issued by the third-party bank conduit plus specified fees. We pay a commitment fee for the note based on the size of the commitment and the amount

of borrowings outstanding.

Our $100 variable funding facility is backed by the remaining 10% interest in the Nordstrom VISA credit card receivables and is available as liquidity

support to our wholly owned federal savings bank, Nordstrom fsb. As of January 31, 2009, no issuances have been made against this facility. Borrowings

under the facility incur interest based upon the cost of commercial paper issued by the third-party bank conduit plus specified fees.

During 2008, we increased our short-term borrowing capacity by exercising the $150 accordion feature on our revolving credit facility. The accordion

feature allowed us to increase our existing $500 unsecured line of credit to $650. In conjunction with the increase of our unsecured line of credit, we

also increased our $500 commercial paper program to $650. The issuance of commercial paper has the effect, while it is outstanding, of reducing our

borrowing capacity under the line of credit by an amount equal to the principal amount of the commercial paper.

Under the terms of the commercial paper agreement, we pay a rate of interest based on, among other factors, the maturity of the issuance and market

conditions. Our unsecured line of credit expires in November 2010.

We currently have an automatic shelf registration statement on file with the Securities and Exchange Commission. Under the terms of the registration

statement, and subject to the filing of certain post-effective amendments, we are authorized to issue an unlimited principal amount of debt securities.

We are continuing to monitor the credit markets to determine the best time to refinance with long-term debt. Our next debt maturity is a $350

securitized note due in April 2010.

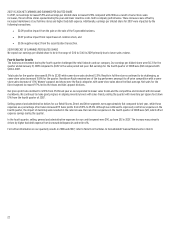

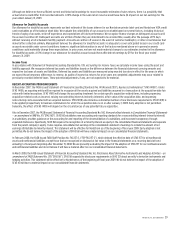

Debt Covenants

Our borrowing facilities include restrictive covenants, including the following significant restrictions:

Facility Description of Covenant

2007–A $300 variable funding note Standard and Poor’s BB+ and Moody’s Ba1 ratings or better

$100 variable funding note Standard and Poor’s BB+ and Moody’s Ba1 ratings or better

$650 commercial paper/unsecured line of credit Leverage ratio (“Adjusted Debt to EBITDAR” not greater than approximately four times)

As of January 31, 2009 and February 2, 2008 we were in compliance with these covenants. We will monitor each of these covenants closely in 2009 to

ensure that we make any necessary adjustments to our plans and believe that we will remain in compliance with this covenant during 2009. See

additional disclosure of Adjusted Debt to EBITDAR on the following page.

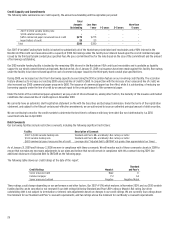

The following table shows our credit ratings at the date of this report:

Credit Ratings Moody’s

Standard

and Poor’s

Senior unsecured debt Baa2 A-

Commercial paper P-2 A-2

Senior unsecured outlook Negative Negative/Watch

These ratings could change depending on our performance and other factors. Our 2007-A VFN, which matures in November 2009, and our $100 variable

funding facility can be cancelled or not renewed if our debt ratings fall below Standard and Poor’s BB+ rating or Moody’s Ba1 rating. Our other

outstanding debt is not subject to termination or interest rate adjustments based on changes in our credit ratings. We are currently four ratings above

the minimum for our Standard and Poor’s covenant requirements, and two ratings above the minimum for our Moody’s covenant requirements.