Nordstrom 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share and per option amounts

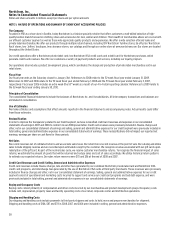

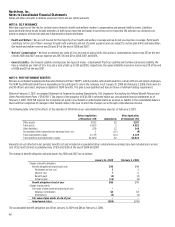

Loyalty Program

Customers who reach a cumulative purchase threshold when using our Nordstrom private label cards or our Nordstrom VISA credit cards receive

Nordstrom Notes®. These Nordstrom Notes can be redeemed for goods or services in our stores. We estimate the net cost of the Nordstrom Notes

that will be issued and redeemed and record this cost as rewards points are accumulated. In addition to this long-standing benefit, in 2007 we

launched an enhanced loyalty program, Fashion Rewards®. Under this program, Nordstrom customers receive higher levels of cumulative benefits

based on their annual spend. We record the cost of the loyalty program benefits for Nordstrom Notes and alterations in cost of sales given that we

provide customers with products or services for these rewards. Other costs of the loyalty program, which primarily include shipping and fashion

events, are recorded as selling, general and administrative expenses. These expenses are recorded based on estimates of benefits expected to be

accumulated and redeemed in relation to sales.

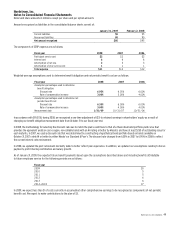

Vendor Allowances

We receive allowances from merchandise vendors for cosmetic selling expenses, purchase price adjustments, cooperative advertising programs and

vendor sponsored contests. Allowances for cosmetic selling expenses are recorded in selling, general and administrative expenses as a reduction to

the related cost when incurred. Purchase price adjustments are recorded as a reduction of cost of sales at the point they have been earned and the

related merchandise has been sold. Allowances for cooperative advertising and promotion programs and vendor sponsored contests are recorded in

cost of sales and related buying and occupancy costs and selling, general and administrative expenses as a reduction to the related cost when

incurred. Any allowances in excess of actual costs incurred that are recorded in selling, general and administrative expenses are recorded as a

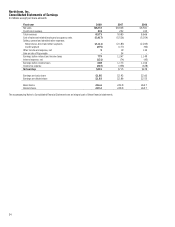

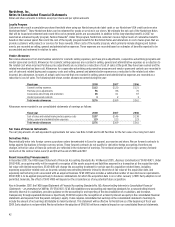

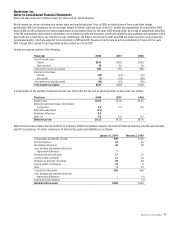

reduction to cost of sales. The following table shows vendor allowances earned during the year:

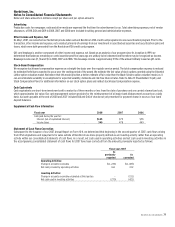

Fiscal year 2008 2007 2006

Cosmetic selling expenses $112 $120 $121

Purchase price adjustments 96 86 70

Cooperative advertising and promotion 65 61 67

Vendor sponsored contests 3 2 3

Total vendor allowances $276 $269 $261

Allowances were recorded in our consolidated statements of earnings as follows:

Fiscal year 2008 2007 2006

Cost of sales and related buying and occupancy costs $157 $146 $138

Selling, general and administrative expenses 119 123 123

Total vendor allowances $276 $269 $261

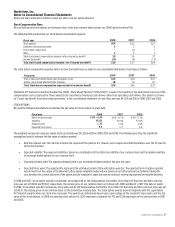

Fair Value of Financial Instruments

The carrying amounts of cash equivalents approximate fair value. See Note 6: Debt and Credit Facilities for the fair value of our long-term debt.

Derivatives Policy

We periodically enter into foreign currency purchase orders denominated in Euros for apparel, accessories and shoes. We use forward contracts to

hedge against fluctuations in foreign currency prices. These forward contracts do not qualify for derivative hedge accounting, therefore any

changes in the fair value of financial contracts are reflected in the statement of earnings. The notional amounts of our foreign currency forward

contracts at the contract rates were $3 and $10 at the end of 2008 and 2007.

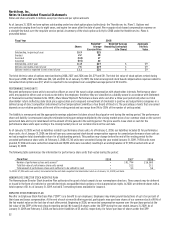

Recent Accounting Pronouncements

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 141 (Revised 2007),

Business Combinations

(“SFAS 141(R)”). Under

SFAS 141(R), an acquiring entity will be required to recognize all the assets acquired and liabilities assumed in a transaction at the acquisition-date

fair value with limited exceptions. SFAS 141(R) will change the accounting treatment for certain specific acquisition-related items, including

expensing acquisition-related costs as incurred, valuing noncontrolling interests (minority interests) at fair value at the acquisition date, and

expensing restructuring costs associated with an acquired business. SFAS 141(R) also includes a substantial number of new disclosure requirements.

SFAS 141(R) is to be applied prospectively to business combinations for which the acquisition date is on or after January 1, 2009. Early adoption is not

permitted. Generally, the effect of SFAS 141(R) will depend on the circumstances of any potential future acquisition.

Also in December 2007, the FASB issued Statement of Financial Accounting Standards No. 160,

Noncontrolling Interests in Consolidated Financial

Statements

—

an amendment of ARB No. 51

(“SFAS 160”). SFAS 160 establishes new accounting and reporting standards for a noncontrolling interest

(minority interest) in a subsidiary, provides guidance on the accounting for and reporting of the deconsolidation of a subsidiary, and increases

transparency through expanded disclosures. Specifically, SFAS 160 requires the recognition of a minority interest as equity in the consolidated financial

statements and separate from the parent company’s equity. It also requires consolidated net earnings in the consolidated statement of earnings to

include the amount of net earnings attributable to minority interest. This statement will be effective for Nordstrom as of the beginning of fiscal year

2009. Early adoption is not permitted. We do not believe the adoption of SFAS 160 will have a material impact on our consolidated financial statements.