Nordstrom 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share and per option amounts

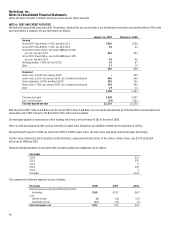

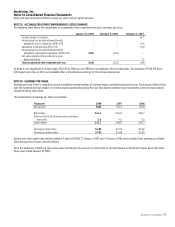

NOTE 8: SELF INSURANCE

We retain a portion of the risk for certain losses related to health and welfare, workers’ compensation and general liability claims. Liabilities

associated with these losses include estimates of both losses reported and losses incurred but not yet reported. We estimate our ultimate cost

based on analysis of historical data and independent actuarial estimates.

• Health and Welfare – We are self insured for the majority of our health and welfare coverage and we do not use stop-loss coverage. Participants

contribute to the cost of their coverage through both premiums and out of pocket expenses and are subject to certain plan limits and deductibles.

Our health and welfare reserve was $16 and $14 at the end of 2008 and 2007.

• Workers’ Compensation – We have a retention per claim of $1 or less and no policy limits. Our workers’ compensation reserve was $53 at the end

of both 2008 and 2007 and our expense was $19, $15 and $21 in 2008, 2007 and 2006.

• General Liability – Our General Liability encompasses two types of losses – Employment Practices Liability and Commercial General Liability. We

have a retention per claim of $1 or less and a policy limit up to $25 and $150, respectively. Our general liability insurance reserve was $11 at the end

of 2008 and $10 at the end 2007.

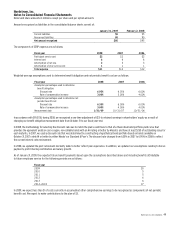

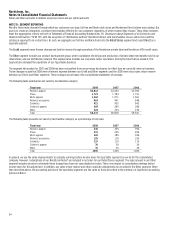

NOTE 9: POST-RETIREMENT BENEFITS

We have an unfunded Supplemental Executive Retirement Plan (“SERP”), which provides retirement benefits to certain officers and select employees.

The SERP has different benefit levels depending on the participant’s role in the company. As of January 31, 2009 and February 2, 2008, there were 33

and 38 officers and select employees eligible for SERP benefits. This plan is non-qualified and does not have a minimum funding requirement.

Effective February 3, 2007, we adopted Statement of Financial Accounting Standards No. 158,

Employers’ Accounting for Defined Benefit Pension and

Other Postretirement Plans

(“SFAS 158”). The impact of the adoption of SFAS 158 is reflected within our consolidated financial statements as of

February 3, 2007. SFAS 158 requires the recognition of a plan’s overfunded or underfunded status as an asset or liability in the consolidated balance

sheet and the recognition of changes in that funded status in the year in which the changes occur through comprehensive income.

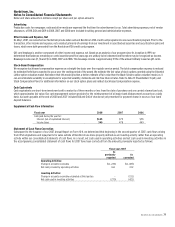

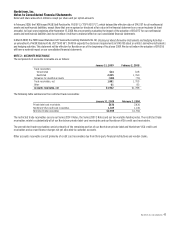

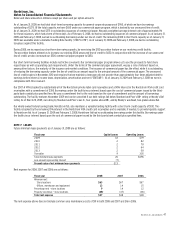

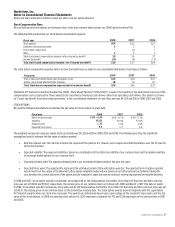

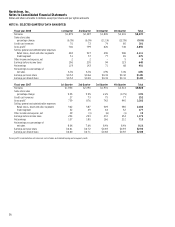

The following table reflects the effects of the adoption of SFAS 158 on our consolidated balance sheet as of February 3, 2007:

Before Application After Application

of Statement 158 Adjustments of Statement 158

Other assets $185 $2 $187

Total assets 4,820 2 4,822

Other liabilities 228 12 240

Accumulated other comprehensive earnings (loss), net 1 (10) (9)

Total shareholders’ equity 2,179 (10) 2,169

Total liabilities and shareholders’ equity $4,820 $2 $4,822

Amounts not yet reflected in net periodic benefit cost and included in accumulated other comprehensive earnings (pre-tax) included prior service

cost of $(2) and $(3) and accumulated loss of $(9) and $(28) at the end of 2008 and 2007.

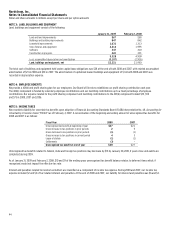

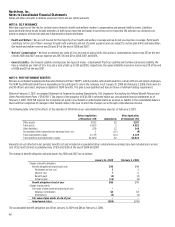

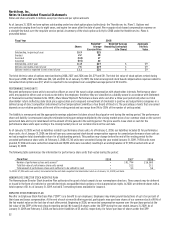

The change in benefit obligation and plan assets for 2008 and 2007 are as follows:

January 31, 2009 February 2, 2008

Change in benefit obligation:

Benefit obligation at beginning of year $95 $98

Participant service cost 3 3

Interest cost 7 6

Benefits paid (4) (4)

Actuarial gain (16) (8)

Benefit obligation at end of year $85 $95

Change in plan assets:

Fair value of plan assets at beginning of year — —

Employer contribution $4 $4

Distributions (4) (4)

Fair value of plan assets at end of year — —

Underfunded status $(85) $(95)

The accumulated benefit obligation was $81 at January 31, 2009 and $86 at February 2, 2008.