Nordstrom 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 47

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share and per option amounts

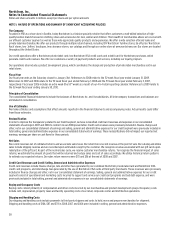

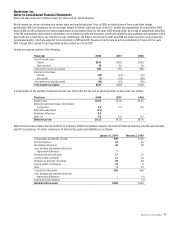

As of January 31, 2009, we had total short-term borrowing capacity for general corporate purposes of $950, of which we have borrowings

outstanding of $275. Of the total capacity, we have $650 under our commercial paper program, which is backed by our unsecured line of credit.

As of January 31, 2009, we had $275 in outstanding issuances of commercial paper. We paid a weighted average interest rate of approximately 1%

for these issuances, which had a term of three days. As of February 2, 2008, we had no outstanding issuances of commercial paper. As of January 31,

2009 and February 2, 2008, we had no outstanding borrowings under our line of credit. The remaining $300 in short-term capacity as of January 31,

2009 was available under a Variable Funding Note facility (“2007-A VFN”). As of January 31, 2009 and February 2, 2008, we had no outstanding

issuances against this facility.

During 2008, we increased our short-term borrowing capacity, by exercising the $150 accordion feature on our revolving credit facility.

The accordion feature allowed us to increase our existing $500 unsecured line of credit to $650. In conjunction with the increase of our unsecured

line of credit, we also increased our $500 commercial paper program to $650.

Our short-term borrowing facilities include restrictive covenants. Our commercial paper program allows us to use the proceeds to fund share

repurchases as well as operating cash requirements. Under the terms of the commercial paper agreement, we pay a rate of interest based on,

among other factors, the maturity of the issuance and market conditions. The issuance of commercial paper has the effect, while it is outstanding,

of reducing the borrowing capacity under the line of credit by an amount equal to the principal amount of the commercial paper. The unsecured

line of credit expires in November 2010 and requires that we maintain a leverage ratio not greater than approximately four times adjusted debt to

earnings before interest, income taxes, depreciation, amortization and rent (“EBITDAR”). As of January 31, 2009 and February 2, 2008 we were in

compliance with this covenant.

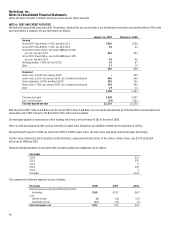

Our 2007-A VFN is backed by substantially all of the Nordstrom private label card receivables and a 90% interest in the Nordstrom VISA credit card

receivables with a commitment of $300. Borrowings under the facility incur interest based upon the cost of commercial paper issued by the third-

party bank conduit plus specified fees. We pay a commitment fee for the note based on the size of commitment and the amount of borrowings

outstanding. The facility matures November 2009 and can be cancelled if our debt ratings fall below Standard and Poor’s BB+ rating or Moody’s Ba1

rating. As of March 20, 2009, our rating by Standard and Poor’s was A-, four grades above BB+, and by Moody’s was Baa2, two grades above Ba1.

Our wholly owned federal savings bank, Nordstrom fsb, also maintains a variable funding facility with a short-term credit capacity of $100. This

facility is backed by the remaining 10% interest in the Nordstrom VISA credit card receivables and is available, if needed, to provide liquidity support

to Nordstrom fsb. As of January 31, 2009 and February 2, 2008, Nordstrom fsb had no outstanding borrowings under this facility. Borrowings under

the facility incur interest based upon the cost of commercial paper issued by the third-party bank conduit plus specified fees.

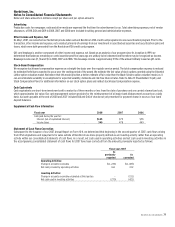

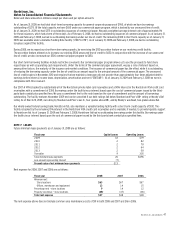

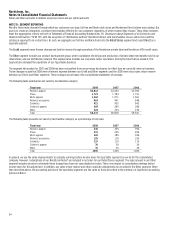

NOTE 7: LEASES

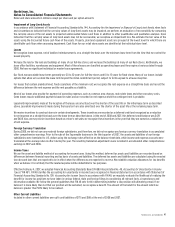

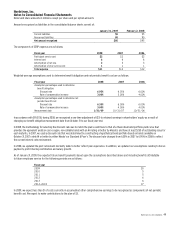

Future minimum lease payments as of January 31, 2009 are as follows:

Fiscal year Capital Leases Operating Leases

2009 $3 $79

2010 2 82

2011 2 78

2012 2 64

2013 2 58

Thereafter 9 335

Total minimum lease payments 20 $696

Less amount representing interest (7)

Present value of net minimum lease payments $13

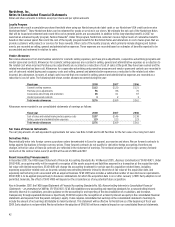

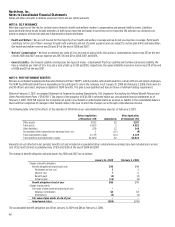

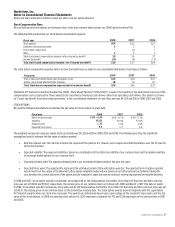

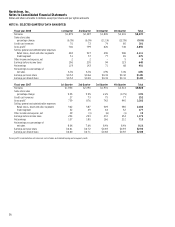

Rent expense for 2008, 2007 and 2006 are as follows:

Fiscal year 2008 2007 2006

Minimum rent:

Store locations $63 $67 $67

Offices, warehouses and equipment 13 14 15

Percentage rent — store locations 9 14 12

Property incentives — store locations (48) (47) (46)

Total rent expense $37 $48 $48

The rent expense above does not include common area maintenance costs of $19 in both 2008 and 2007 and $16 in 2006.