Nordstrom 2008 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2008 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

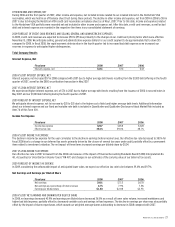

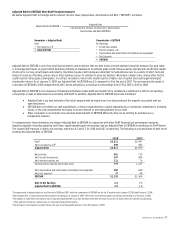

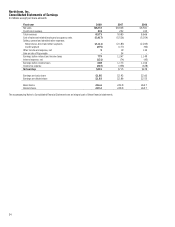

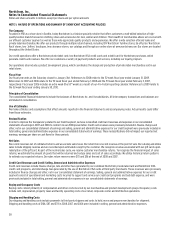

Contractual Obligations

The following table summarizes our contractual obligations and the expected effect on our liquidity and cash flows as of January 31, 2009. We expect to

fund these commitments primarily with operating cash flows generated in the normal course of business and credit available to us under existing and

potential future facilities.

Total

Less than

1 year 1–3 years 3–5 years

More than

5 years

Long-term debt $3,759 $134 $549 $690 $2,386

Capital lease obligations 20 3 4 4 9

Other long-term liabilities 178 13 39 25 101

Operating leases 696 79 160 122 335

Purchase obligations 1,059 983 72 4 -

Total $5,712 $1,212 $824 $845 $2,831

Included in the required debt repayments disclosed above are estimated total interest payments of $1,534 as of January 31, 2009, payable over the

remaining life of the debts.

Other long-term liabilities consist of workers’ compensation and general liability insurance reserves, postretirement benefits and a portion of our

Financial Accounting Standards Board (FASB) Interpretation No. 48,

Accounting for Uncertainty in Income Taxes

(“FIN 48”) reserves. The repayment

amounts presented above were determined based on historical payment trends. We expect to pay $13 of uncertain tax positions under FIN 48 in the

next 12 months and include this balance in other long-term liabilities as due in less than one year. We are unable to reasonably estimate the timing of

future cash flows for the remaining FIN 48 balance and have excluded this from the table above. Other long-term liabilities not requiring cash

payments, such as deferred property incentives and deferred revenue, were excluded from the table above.

Purchase obligations primarily consist of purchase orders for unreceived goods or services and capital expenditure commitments.

This table also excludes the short-term liabilities, other than the current portion of long-term debt, disclosed on our 2008 consolidated balance sheet,

as the amounts recorded for these items will be paid in the next year.

CRITICAL ACCOUNTING ESTIMATES

The preparation of our financial statements requires that we make estimates and judgments that affect the reported amounts of assets, liabilities,

revenues and expenses, and disclosure of contingent assets and liabilities. We base our estimates on historical experience and on other assumptions that

we believe to be reasonable under the circumstances. Actual results may differ from these estimates. The following discussion highlights the estimates

we feel are critical and should be read in conjunction with the Notes to the Consolidated Financial Statements.

Our management has discussed the development and selection of these critical accounting estimates with the Audit Committee of our Board of

Directors and the Audit Committee has reviewed the company’s disclosures that follow.

Inventory

Our merchandise inventories are primarily stated at the lower of cost or market using the retail inventory method. Under the retail method, the

valuation of inventories and the resulting gross margins are determined by applying a calculated cost-to-retail ratio to the retail value of ending

inventory. To determine if the retail value of our inventory should be marked down, we consider current and anticipated demand, customer

preferences, age of the merchandise and fashion trends. As our inventory retail value is adjusted regularly to reflect market conditions, our inventory

is valued at the lower of cost or market. Inherent in the retail inventory method are certain management judgments that may affect the ending

inventory valuation as well as gross margin. Among others, the significant estimates used in inventory valuation are obsolescence and shrinkage.

We reserve for obsolescence based on historical trends and specific identification. Shrinkage is estimated as a percentage of net sales for the period

from the most recent semi-annual inventory count based on historical shrinkage results. Therefore, our obsolescence reserve and shrinkage

percentage contain uncertainties as the calculations require management to make assumptions and to apply judgment regarding a number of factors,

including market conditions, the selling environment, historical results and current inventory trends.

Management does not believe that the assumptions used in these estimates will change significantly based on prior experience. In prior years, we have

made no material changes to our estimates included in the calculations of the obsolescence and shrinkage reserves. We do not believe a 10% change in

the obsolescence reserve or our shrink percentage would have a material effect on our net earnings.

Revenue Recognition

We recognize revenues net of estimated returns and we exclude sales taxes. Our retail stores record revenue at the point of sale. Our catalog and

online sales include shipping revenue and are recorded upon estimated delivery to the customer. As part of the normal sales cycle, we receive

customer merchandise returns. To recognize the financial impact of sales returns, we estimate the amount of goods that will be returned and reduce

sales and cost of sales accordingly. Inherent in establishing and maintaining a sales return reserve are management judgments around customer

return patterns and return rates. We utilize historical return patterns to estimate our expected returns.