Nordstrom 2008 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2008 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share and per option amounts

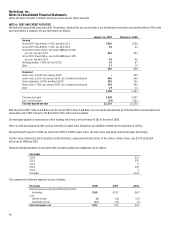

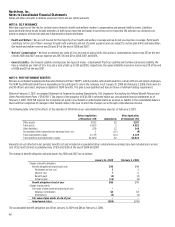

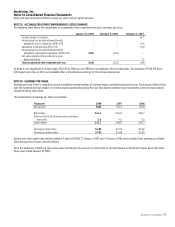

NOTE 10: SALE OF FAÇONNABLE

During the third quarter of 2007, we completed the sale of our Façonnable business in exchange for cash of $216, net of transaction costs. As part of

this transaction, goodwill of $28, acquired tradename of $84, and foreign currency translation of $16 were removed from our consolidated balance

sheet and we recorded a gain of $34. Upon the closing of this transaction, we entered into a Transition Services Agreement, whereby we will

continue to provide certain back office functions related to the Façonnable U.S. wholesale business for a limited amount of time as part of a

transition period.

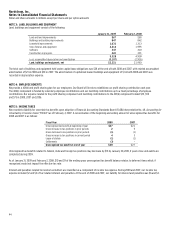

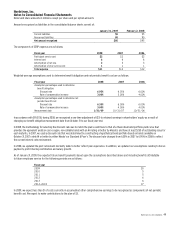

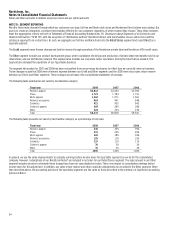

NOTE 11: COMMITMENTS AND CONTINGENT LIABILITIES

We are involved in routine claims, proceedings and litigation arising in the normal course of our business. We do not believe any such claim,

proceeding or litigation, either alone or in aggregate, will have a material impact on our results of operations, financial position or liquidity. Our

estimated total purchase obligations, capital expenditure contractual commitments and inventory purchase orders were $1,059 as of January 31,

2009. In connection with the purchase of foreign merchandise, we have outstanding import letters of credit totaling $5 as of January 31, 2009.

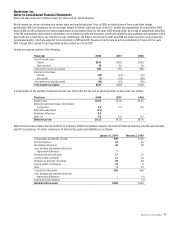

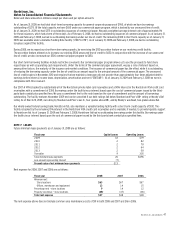

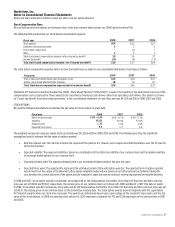

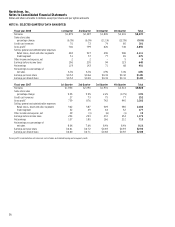

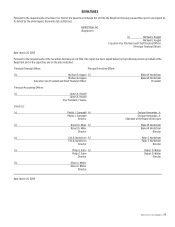

NOTE 12: SHAREHOLDERS’ EQUITY AND STOCK COMPENSATION PLANS

Share Repurchase Program

2008 SHARE REPURCHASES

During 2008 we repurchased 6.9 shares for $238 at an average price of $34.29. Although our share repurchase program will not expire until August

2009, we suspended the program in September 2008. We may resume the program in the future if economic conditions improve. As of January 31,

2009, we had $1,126 in remaining capacity under our share repurchase program. The actual amount and timing of future share repurchases will be

subject to market conditions and applicable Securities and Exchange Commission rules.

2007 SHARE REPURCHASES

In August 2007, our Board of Directors authorized a $1,500 share repurchase program and in November 2007 authorized an additional $1,000 for

share repurchases.

During 2007, we repurchased 39.1 shares for $1,728 at an average price per share of $44.17, including $300 repurchased as part of an accelerated

share repurchase program. We repurchased 5.4 shares of our common stock on May 23, 2007 at $55.17 per share and in June 2007, we received 0.4

shares at no additional cost, based on the volume weighted average price of our common stock from June 1, 2007 to June 26, 2007. This resulted in

an average price per share of $51.69 for the accelerated share repurchase as a whole.

2006 SHARE REPURCHASES

At the beginning of 2006, we had $213 remaining from a program authorized by our Board of Directors in February 2005. In 2006, our Board of

Directors authorized an additional $1,000 of share repurchases. In 2006, we repurchased 16.5 shares for $621 at an average price of $37.57 per share.

Dividends

In 2008, we paid dividends of $0.64 per share. We paid dividends of $0.54 and $0.42 in 2007 and 2006.