Nordstrom 2008 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2008 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share and per option amounts

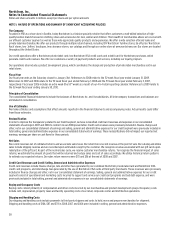

Securitization of Accounts Receivable

Prior to May 2007, through our wholly owned federal savings bank, Nordstrom fsb, we offered a private label card and two Nordstrom VISA credit

cards. The private label card receivables were held in a trust, which could issue third-party debt that was secured by the private label receivables;

the private label program was treated as ‘on-balance sheet,’ with the receivables, net of bad debt allowance, and debt, if any, recorded on our

consolidated balance sheet, the finance charge income recorded in credit card revenues, and the bad debt expense recorded in credit segment

selling, general and administrative expenses.

The Nordstrom VISA credit card receivables were held in a separate trust (the VISA Trust), which could issue third-party debt that was secured by the

Nordstrom VISA credit card receivables. The Nordstrom VISA credit card program was treated as ‘off-balance sheet.’ We recorded the fair value of

our interest in the VISA Trust on our consolidated balance sheet, gains on the sale of receivables to the VISA Trust and our share of the VISA Trust’s

finance income in other income and expense, net.

On May 1, 2007, we converted the Nordstrom private label cards and Nordstrom VISA credit card programs into one securitization program, which is

accounted for as a secured borrowing (on-balance sheet). When we combined the securitization programs, our investment in asset backed securities,

which was accounted for as available-for-sale securities, was eliminated and we reacquired all of the Nordstrom VISA credit card receivables

previously held off-balance sheet. These reacquired Nordstrom VISA credit card receivables were recorded at fair value at the date of acquisition.

We have transitioned the Nordstrom VISA credit card receivable portfolio to historical cost, net of bad debt allowances, on our consolidated

balance sheet.

Also on May 1, 2007, the trust issued securities that are backed by substantially all of the Nordstrom private label card receivables and 90% of the

Nordstrom VISA credit card receivables. Under the securitization, the receivables are transferred to a third-party trust on a daily basis. The balance

of the receivables transferred to the trust fluctuates as new receivables are generated and old receivables are retired (through payments received,

charge-offs or credits for merchandise returns). These combined receivables back the Series 2007-1 Notes, the Series 2007-2 Notes, and two unused

variable funding notes that are discussed in Note 6: Debt and Credit Facilities.

Our credit card securitization agreements set a maximum percentage of receivables that can be associated with various receivable categories, such

as employee or foreign receivables. As of January 31, 2009 and February 2, 2008, these maximums were not exceeded.

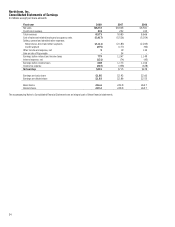

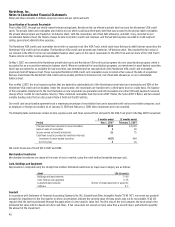

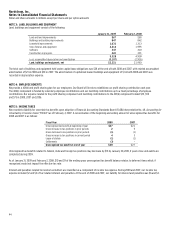

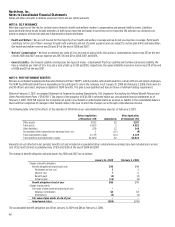

The following table summarizes certain income, expenses and cash flows received from and paid to the VISA Trust prior to the May 2007 transaction:

3 months ended 12 months ended

Period May 1, 2007 February 3, 2007

Principal collections reinvested in new receivables $819 $3,094

Gains on sales of receivables 3 20

Income earned on beneficial interests 21 75

Cash flows (used in) provided by beneficial interests:

Investment in asset backed securities (457) 494

Servicing fees 2 16

Net credit losses were $9 and $22 in 2007 and 2006.

Merchandise Inventories

Merchandise inventories are valued at the lower of cost or market, using the retail method (weighted average cost).

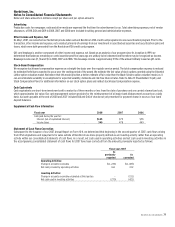

Land, Buildings and Equipment

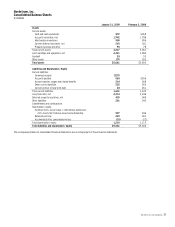

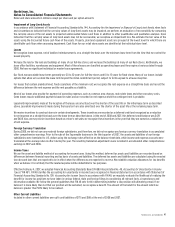

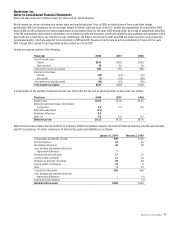

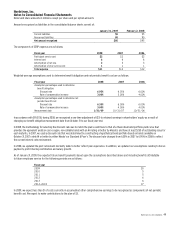

Depreciation is computed using the straight-line method. Estimated useful lives by major asset category are as follows:

Asset Life (in years)

Buildings and improvements 5–40

Store fixtures and equipment 3–15

Leasehold improvements Shorter of initial lease term or asset life

Software 3–7

Goodwill

In accordance with Statement of Financial Accounting Standards No. 142,

Goodwill and Other Intangible Assets

(“SFAS 142”), we review our goodwill

annually for impairment in the first quarter or when circumstances indicate the carrying value of these assets may not be recoverable. SFAS 142

requires that the test be performed through the application of a two-step fair value test. The first step of the test compares the book value to the

estimated fair value which is based on future cash flows. If fair value does not exceed carrying value then a second step is performed to quantify

the amount of the impairment.