Nordstrom 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 51

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share and per option amounts

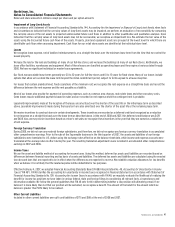

Stock Compensation Plans

We currently grant stock options, performance share units and common shares under our 2004 Equity Incentive Plan.

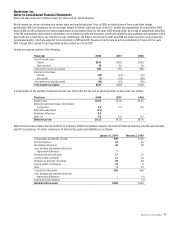

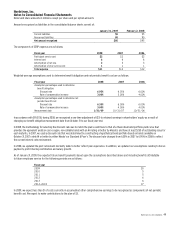

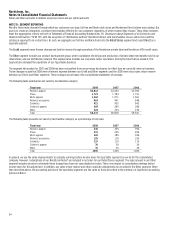

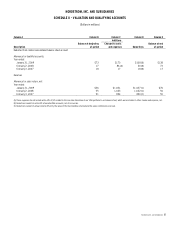

The following table summarizes our stock-based compensation expense:

Fiscal year 2008 2007 2006

Stock options $24

$23 $27

Employee stock purchase plan 2 2 2

Performance share units – (1) 7

Other 2 2 1

Total stock-based compensation expense before income tax benefit 28 26 37

Income tax benefit (10) (9) (13)

Total stock-based compensation expense, net of income tax benefit $18

$17 $24

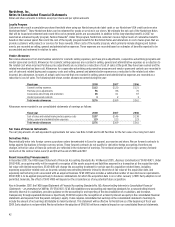

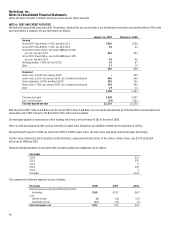

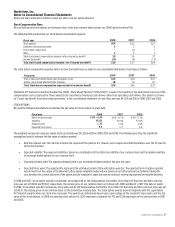

The stock-based compensation expense before income tax benefit was recorded in our consolidated statements of earnings as follows:

Fiscal year 2008 2007 2006

Cost of sales and related buying and occupancy costs $10

$10 $12

Selling, general and administrative expenses 18 16 25

Total stock-based compensation expense before income tax benefit $28

$26 $37

Statement of Financial Accounting Standard No. 123(R),

Share-Based Payment

(“SFAS 123(R)”), requires the benefits of tax deductions in excess of the

compensation cost recognized for those awards to be classified as financing cash inflows rather than operating cash inflows. This amount is shown

as “Excess tax benefit from stock-based payments” in the consolidated statement of cash flows and was $4, $26 and $38 in 2008, 2007 and 2006.

STOCK OPTIONS

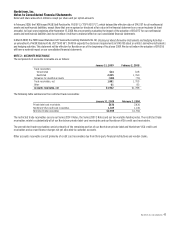

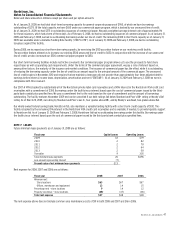

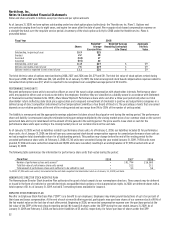

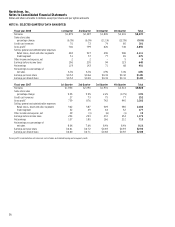

We used the following assumptions to estimate the fair value for stock options at grant date:

Fiscal year 2008 2007 2006

Risk-free interest rate 2.0% – 4.3% 4.6% – 4.7% 4.9% – 5.1%

Volatility 45.0% 35.0% 37.0%

Dividend yield 1.3% 1.0% 1.0%

Expected life in years 5.5 5.7 5.4

The weighted average fair value per option at the grant date was $15, $20 and $16 in 2008, 2007 and 2006. The following describes the significant

assumptions used to estimate the fair value of options granted:

• Risk-free interest rate: The risk-free interest rate represents the yield on U.S. Treasury zero-coupon securities that mature over the 10-year life

of the stock options.

• Expected volatility: The expected volatility is based on a combination of the historical volatility of our common stock and the implied volatility

of exchange traded options for our common stock.

• Expected dividend yield: The expected dividend yield is our forecasted dividend yield for the next ten years.

• Expected life in years: The expected life represents the estimated period of time until option exercise. The expected term of options granted

was derived from the output of the Binomial Lattice option valuation model and was based on our historical exercise behavior taking into

consideration the contractual term of the option and our employees’ expected exercise and post-vesting employment termination behavior.

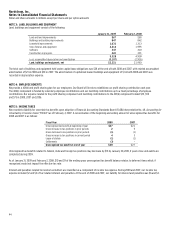

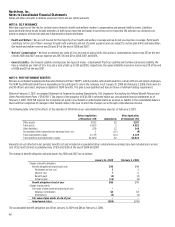

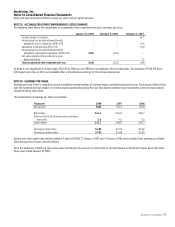

In 2008 and 2007, stock option awards to employees were approved by the Compensation Committee of our Board of Directors and their exercise

price was set at $38.02 and $53.63, respectively, the closing price of our common stock on February 28, 2008 and March 1, 2007 (the date of grant).

In 2006, stock option awards to employees were approved by the Compensation Committee of our Board of Directors and their exercise price was set

at $40.27, the closing price of our common stock on the Committee meeting date. The stock option awards provide recipients with the opportunity

for financial rewards when our stock price increases. The awards are determined based upon a percentage of the recipients’ base salary and the fair

value of the stock options. In 2008, we awarded stock options to 1,230 employees compared to 1,195 and 1,236 employees in the same periods in 2007

and 2006.