Nordstrom 2008 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2008 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.22

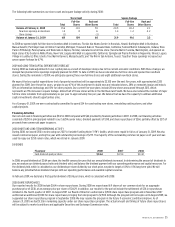

2007 VS 2006 NET EARNINGS AND EARNINGS PER DILUTED SHARE

In 2007, net earnings increased 5.5% and earnings per diluted share increased 12.9% compared with 2006 as a result of same-store sales

increases, three full-line stores opened during the year and lower incentive costs tied to company performance. These increases were offset by

increased markdowns at our full-line stores and higher bad debt expense. Additionally, earnings per diluted share for 2007 were impacted by the

following transactions:

• $0.09 positive impact from the gain on the sale of the Façonnable business,

• $0.07 positive impact from repurchases of common stock, and

• $0.06 negative impact from the securitization transaction.

2009 FORECAST OF EARNINGS PER DILUTED SHARE

We expect our earnings per diluted share to be in the range of $1.10 to $1.40 in 2009 primarily due to lower sales volume.

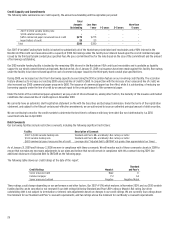

Fourth Quarter Results

The business environment during the fourth quarter challenged the retail industry and our company. Our earnings per diluted share were $0.31 for the

quarter ended January 31, 2009 compared to $0.92 in the same period last year. Net earnings for the fourth quarter of 2008 were $68 compared with

$212 in 2007.

Total sales for the quarter decreased 8.5% to $2,301 while same-store sales declined 12.5%. Results in full-line stores continued to be challenging, as

same-store sales decreased 15.8% for the quarter. Nordstrom Rack remained one of the top performers amongst its off-price competition with a same-

store sales decrease of 1.5%. Women’s apparel and shoes were the Rack categories with same-store sales above the Rack average. Net sales for the

Direct segment increased 9.7%, led by the shoes and kids’ apparel divisions.

Our gross profit rate declined to 32.0% from 37.6% last year as we responded to slower sales trends and the competitive environment with increased

markdowns. We continued to make good progress in aligning inventory levels with sales trends, ending the quarter with inventory per square foot down

12% from the fourth quarter of 2007.

Selling, general and administrative dollars for our Retail Stores, Direct and Other segments were approximately flat compared to last year, while these

expenses as a percentage of net sales increased 191 basis points from 23.3% to 25.2%. Although we continued to vigorously control our expenses in the

fourth quarter, the impact of declining sales resulted in the rate increase. Our new stores expenses in the fourth quarter of 2008 were $20, which offset

expense savings during the quarter.

In the fourth quarter, selling, general and administrative expenses for our credit segment were $90, up from $52 in 2007. The increase was primarily

driven by higher bad debt expense from increased delinquencies and write-offs.

For further information on our quarterly results in 2008 and 2007, refer to Note 16 in the Notes to Consolidated Financial Statements in Item 8.