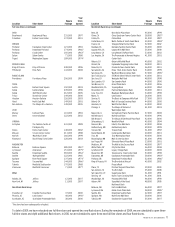

Nordstrom 2008 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2008 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Nordstrom, Inc. and subsidiaries 15

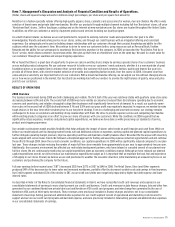

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

(Dollar, share and square footage amounts in millions except percentages, per share and per square foot amounts)

Nordstrom is a fashion specialty retailer offering high-quality apparel, shoes, cosmetics and accessories for women, men and children. We offer a wide

selection of brand name and private label merchandise. We offer our products through multiple channels including full-line ‘Nordstrom’ stores, off-price

‘Nordstrom Rack’ stores, ‘Jeffrey’ boutiques, catalogs and on the Internet at www.nordstrom.com. Our stores are located throughout the United States.

In addition, we offer our customers a variety of payment products and services including our loyalty program.

As a multi-channel retailer, we believe we are well positioned to respond to evolving customer needs and expectations. Our goal is to offer

knowledgeable, friendly and welcoming service in our stores, online, and through our credit business with an integrated offering and consistent

experience. Our salespeople are focused on building deeper relationships with our customers through their product knowledge and ability to offer

solutions which save the customer’s time. We continue to strive to serve our customers better, using resources such as Personal Book, Fashion

Rewards and the ability for our salespeople to seamlessly find inventory anywhere in the company. In 2008, we launched the “Buy Online, Pick Up in

Store” service, which allows customers to purchase online, then pick up their item at a Nordstrom store on the same day. We want to create value for

our customers through our seamless and unique shopping experience.

We’ve found that there’s a great deal of opportunity to grow our sales in existing stores simply by earning a greater share of our customers’ business

across multiple product categories. We use customer research to better serve our customers’ needs and wants, whether it is a new wardrobe of great

foundation pieces or an updated item to enhance their current attire. Our customer still wants newness, fashion, quality and brands. Our goal is to

provide all of these items, with a best-in-market selection of versatile and compelling fashion brands. Over the course of 2008, it became clear that

value and price sensitivity are important factors to our customers. With a broad merchandise offering, we can adjust our mix without changing who we

are or how we are positioned in the market. Our merchants are working hard with our vendors to provide the right balance of quality, value and price

points to our customers.

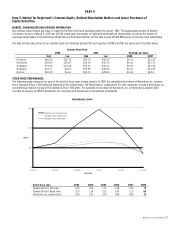

RESULTS OF OPERATIONS

2008 Overview

The business environment during 2008 was both challenging and volatile. The first half of the year was relatively stable with quarterly same-store sales

decreasing between 6.0% and 6.5%. The second half of 2008 was more volatile as consumers reduced their discretionary spending due to economic

concerns and uncertainty, and retailers struggled to align their businesses with significantly lower levels of demand. As a result, our quarterly same-

store sales in the second half of 2008 declined between 11.1% and 12.5% and our gross profit was negatively impacted. In response, we needed to make

tough choices in the near term while remaining true to our long-term strategy. Even in a challenging and uncertain economy, our strategy remains

unchanged in its focus on customers and building strong relationships with them. We strive to provide superior service and compelling merchandise

within existing product categories in an effort to grow our share of business with core customers. While the conditions in 2008 required that we

significantly reduce expenses, inventory and planned capital expenditures, we believe we have done so while preserving our standards of service,

product and shopping experience.

Our variable cost business model provides flexibility that helps mitigate the impact of slower sales trends on profit margins and cash flows. While we

believe our model adjusts well to changing market trends, we took additional actions on expenses, working capital and planned capital expenditures to

further mitigate operating margin pressure, improve operating cash flow and maintain a healthy balance sheet. We ended the fiscal year with inventory

levels aligned with current sales trends. We followed a disciplined approach to finding and executing expense reduction opportunities and will continue

these efforts through 2009. Given the current economic conditions, our capital expenditures in 2009 will be significantly reduced compared to our plan

last year. These changes include reducing the number of major full-line store remodels from approximately six per year to approximately two per year.

Additionally, the economic environment has affected our real estate development partners, who have delayed or canceled several of our planned new

full-line stores. We are continuously monitoring our capital expenditure plans as economic conditions change. Although we have reduced our planned

capital expenditures overall, we did not reduce our maintenance expenditures budget, as it is important that we maintain the look, feel and experience

of shopping in our stores. Overall, we believe we are well positioned to weather the economic downturn, while maintaining an unwavering focus on our

customers and positioning the company for the future.

Full year earnings before income taxes (“EBT”) decreased $525 from $1,173 in 2007 to $648 in 2008. The Retail Stores, Direct and Other segments

produced $491 of this decrease due to lower sales and increased markdowns, partially offset by decreased variable costs and savings in fixed expenses.

Our Credit segment contributed $34 of the decline in EBT, as our credit card yields were negatively impacted by higher bad debt expense and lower

interest rates.

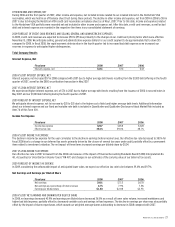

As described in Note 1 of the Notes to Consolidated Financial Statements in Item 8, we have reclassified credit card revenues and expenses in our

consolidated statements of earnings to more clearly present our credit card business. Credit card revenues include finance charges, late and other fees

generated by our combined Nordstrom private label card and Nordstrom VISA credit card programs, and interchange fees generated by the use of

Nordstrom VISA cards at third-party merchants. These revenues were previously included in finance charges and other, net in our consolidated

statement of earnings. Selling, general and administrative expenses for our credit segment consist of operational and marketing costs incurred to

support and service our credit card programs and bad debt expense, and were previously included in total selling, general and administrative expenses

in our consolidated statements of earnings.