Nordstrom 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

5 ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended January 31, 2009

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from____________ to ____________

Commission file number 001-15059

NORDSTROM, INC.

(Exact name of Registrant as specified in its charter)

Washington 91-0515058

(State or other jurisdiction of

incorporation or organization)

(IRS employer

Identification No.)

1617 Sixth Avenue, Seattle, Washington 98101

(Address of principal executive offices) (Zip code)

Registrant’s telephone number, including area code: 206-628-2111

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

Common stock, without par value New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES 5 NO

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES NO 5

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act

of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days. YES 5 NO

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained,

to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any

amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer 5 Accelerated filer

Non-accelerated filer (Do not check if a smaller reporting company) Smaller reporting company

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES NO 5

As of August 1, 2008 the aggregate market value of the Registrant’s voting and non-voting stock held by non-affiliates of the Registrant

was approximately $5.2 billion using the closing sales price on that day of $28.92. On March 11, 2009, 215,485,680 shares of common stock

were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the 2009 Annual Meeting of Shareholders scheduled to be held on May 19, 2009 are incorporated into Part III.

Table of contents

-

Page 1

... of August 1, 2008 the aggregate market value of the Registrant's voting and non-voting stock held by non-affiliates of the Registrant was approximately $5.2 billion using the closing sales price on that day of $28.92. On March 11, 2009, 215,485,680 shares of common stock were outstanding. DOCUMENTS... -

Page 2

[This page intentionally left blank.] 2 -

Page 3

.... Other Information. Directors, Executive Officers and Corporate Governance. Executive Compensation. Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters. Certain Relationships and Related Transactions. Principal Accounting Fees and Services. 4 6 9 9 12... -

Page 4

...apparel, shoes, cosmetics and accessories by serving our customers on the Internet at www.nordstrom.com and through our catalogs. The Direct segment's sales are primarily shipped via third-party carriers from our fulfillment center in Cedar Rapids, Iowa. Through our wholly owned federal savings bank... -

Page 5

...Web site. CORPORATE GOVERNANCE We have a long-standing commitment to upholding a high level of ethical standards. In addition, as required by the listing standards of the New York Stock Exchange ("NYSE") and the rules of the SEC, we have adopted Codes of Business Conduct and Ethics for our employees... -

Page 6

...our customer relationships. CAPITAL MANAGEMENT AND LIQUIDITY Our goal is to invest capital to maximize our overall long-term returns. This includes spending on inventory, capital projects and expenses, managing debt levels, managing accounts receivable through our credit business and returning value... -

Page 7

... of our total sales are derived from stores located on the west and east coasts, particularly California, which increases our dependence on local economic conditions within these states. The success of our credit card business is also highly dependent on our customers' ability to pay and our ability... -

Page 8

... cost of regulatory compliance and restatements of our financial statements. MULTI-CHANNEL STRATEGY EXECUTION Over the past several years, we have made changes in our Direct business that better align our online shopping environment with the customer experience in our full-line stores. These changes... -

Page 9

... center in Cedar Rapids, Iowa, which is owned on leased land. Our administrative offices in Seattle, Washington are a combination of leased and owned space. We also lease an office building in the Denver, Colorado metropolitan area that serves as an office of Nordstrom fsb and Nordstrom Credit... -

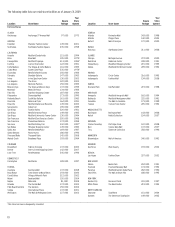

Page 10

... MISSOURI Des Peres NEVADA Las Vegas NEW JERSEY Edison Freehold Paramus Short Hills NEW YORK Garden City White Plains NORTH CAROLINA Charlotte Durham Perimeter Mall Phipps Plaza Mall of Georgia 243,000 140,000 172,000 1998 2005 2000 Chandler Fashion Center Scottsdale Fashion Square 149,000 235... -

Page 11

... Rack Factoria Mall Rack Golde Creek Plaza Rack Downtown Seattle Rack NorthTown Mall Rack Southcenter Square Rack Square Footage Year Store Opened Beachwood Place Easton Town Center 231,000 174,000 1997 2001 Clackamas Town Center Downtown Portland Lloyd Center Salem Center Washington Square... -

Page 12

..., proceedings and litigation arising from the normal course of our business. We do not believe any such claim, proceeding or litigation, either alone or in aggregate, will have a material impact on our financial condition, results of operations or cash flows. Item 4. Submission of Matters to a Vote... -

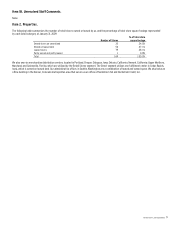

Page 13

..., as well as the number of employee shareholders in the Nordstrom 401(k) Plan and Profit Sharing Plan. On this date we had 215,485,680 shares of common stock outstanding. The high and low sales prices of our common stock and dividends declared for each quarter of 2008 and 2007 are presented in... -

Page 14

... assets Current liabilities Land, buildings and equipment, net Long-term debt, including current portion Shareholders' equity Book value per share Total assets Store Information (at year end) Full-line stores Rack and other stores International Façonnable boutiques Total square footage 1 2008... -

Page 15

...Condition and Results of Operations. (Dollar, share and square footage amounts in millions except percentages, per share and per square foot amounts) Nordstrom is a fashion specialty retailer offering high-quality apparel, shoes, cosmetics and accessories for women, men and children. We offer a wide... -

Page 16

... Our new "Buy Online, Pick Up in Store" service proved to be a convenient and valued service for our customers over the holiday gift-giving season. During 2008 we opened eight new full-line and six new Rack stores. These new stores represent 3.3% of our total net sales for fiscal 2008, and increased... -

Page 17

... Rack stores. In total, we plan to open three new full-line stores and eight additional Rack stores during the year. This will increase retail square footage by approximately 3.7%. We expect 2009 same-store sales to decrease approximately 10% to 15%. Based on the pace of business in 2008, same-store... -

Page 18

... related to our new stores. During 2008, we opened eight new full-line stores and six new Rack stores, which contributed $72 of additional expenses. Our selling, general and administrative expenses as a percentage of net sales increased 79 basis points. The increase as a percentage of net sales... -

Page 19

...thousand points, customers receive twenty dollars in Nordstrom Notes®, which can be redeemed for goods or services in our stores. As customers increase their level of spending they receive additional benefits, including rewards such as complimentary shipping and alterations in our retail stores. We... -

Page 20

... the rewards program. The increase in cost of sales expense in 2007 compared with 2006 was due to growth in volume. CREDIT SELLING, GENERAL AND ADMINISTRATIVE EXPENSES Selling, general and administrative expenses for our credit segment are made up of bad debt and operational and marketing expenses... -

Page 21

... card pricing terms which were effective November 15, 2008. We anticipate selling, general and administrative expense dollars for our credit segment to be approximately flat to down $15 compared to 2008. In fiscal 2008, the rapid economic deterioration in the fourth quarter led to increased bad debt... -

Page 22

... competitive environment with increased markdowns. We continued to make good progress in aligning inventory levels with sales trends, ending the quarter with inventory per square foot down 12% from the fourth quarter of 2007. Selling, general and administrative dollars for our Retail Stores, Direct... -

Page 23

... to return on assets, it provides investors with a useful tool to evaluate our ongoing operations and our management of assets from period to period. Over the past several years, we have incorporated ROIC into our key financial metrics, and since 2005 have used it as an executive incentive measure... -

Page 24

... used for accounts receivable originated at third parties, which was $232 in 2008 compared with $151 in 2007. The Nordstrom VISA credit cards enable our customers to purchase at merchants outside of Nordstrom and accumulate points for our Nordstrom Fashion Rewards® program (two points per dollar... -

Page 25

...these openings increased our gross square footage by 6.7%. 2009 AND LONG-TERM CAPITAL EXPENDITURES FORECAST During 2008 we made adjustments to our capital plan as a result of developer delays due to the current economic conditions. With these changes, we delayed two planned store openings originally... -

Page 26

... Nordstrom private label card receivables and a 90% interest in the Nordstrom VISA credit card receivables with a capacity of $300. Borrowings under the facility incur interest based upon the cost of commercial paper issued by the third-party bank conduit plus specified fees. We pay a commitment fee... -

Page 27

...debt levels at a point which we believe will help us maintain an investment grade credit rating as well as operate with an efficient capital structure for our size, growth plans and industry. Investment grade credit ratings are important to maintaining access to a variety of short-term and long-term... -

Page 28

... and we exclude sales taxes. Our retail stores record revenue at the point of sale. Our catalog and online sales include shipping revenue and are recorded upon estimated delivery to the customer. As part of the normal sales cycle, we receive customer merchandise returns. To recognize the financial... -

Page 29

...change in the sales return reserve would have had a $4 impact on our net earnings for the year ended January 31, 2009. Allowance for Doubtful Accounts Our allowance for doubtful accounts represents our best estimate of the losses inherent in our Nordstrom private label card and Nordstrom VISA credit... -

Page 30

... in U.S. dollars. However, we periodically enter into foreign currency purchase orders denominated in Euros for apparel, accessories and shoes. We use forward contracts to hedge against fluctuations in foreign currency prices. We do not believe the fair value of our outstanding forward contracts... -

Page 31

... audit Nordstrom's consolidated financial statements and the effectiveness of the Company's internal control over financial reporting. Its accompanying reports are based on audits conducted in accordance with the standards of the Public Company Accounting Oversight Board (United States). /s/ Michael... -

Page 32

..., in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated financial statements and financial statement schedule as of and for the year ended January 31, 2009, of the Company and our report dated March 20, 2009, expressed an unqualified... -

Page 33

... ACCOUNTING FIRM To the Board of Directors and Shareholders of Nordstrom, Inc. Seattle, Washington We have audited the accompanying consolidated balance sheets of Nordstrom, Inc. and subsidiaries (the "Company") as of January 31, 2009 and February 2, 2008, and the related consolidated statements... -

Page 34

Nordstrom, Inc. Consolidated Statements of Earnings In millions except per share amounts Fiscal year Net sales Credit card revenues Total revenues Cost of sales and related buying and occupancy costs Selling, general and administrative expenses: Retail stores, direct and other segments Credit ... -

Page 35

..., wages and related benefits Other current liabilities Current portion of long-term debt Total current liabilities Long-term debt, net Deferred property incentives, net Other liabilities Commitments and contingencies Shareholders' equity: Common stock, no par value: 1,000 shares authorized; 215... -

Page 36

...of ($5) Fair value adjustment to investment in asset backed securities, net of tax of $3 Comprehensive net earnings Cash dividends paid ($0.54 per share) Issuance of common stock for: Stock option plans Employee stock purchase plan Other Stock-based compensation Repurchase of common stock Balance at... -

Page 37

...Principal payments on long-term borrowings Increase (decrease) in cash book overdrafts Proceeds from exercise of stock options Proceeds from employee stock purchase plan Excess tax benefit from stock-based payments Cash dividends paid Repurchase of common stock Other, net Net cash (used in) provided... -

Page 38

... of Nordstrom VISA cards at third-party merchants. These revenues were previously included in finance charges and other, net in our consolidated statement of earnings. Selling, general and administrative expenses for our credit segment consist of operational and marketing costs incurred to support... -

Page 39

... of purchase and are carried at amortized cost, which approximates fair value. Our cash management system provides for the reimbursement of all major bank disbursement accounts on a daily basis. Accounts payable at the end of 2008 and 2007 included $66 and $46 of checks not yet presented for payment... -

Page 40

... savings bank, Nordstrom fsb, we offered a private label card and two Nordstrom VISA credit cards. The private label card receivables were held in a trust, which could issue third-party debt that was secured by the private label receivables; the private label program was treated as 'on-balance... -

Page 41

... to rent expense on a straight-line basis over the lease term as described above. At the end of 2008 and 2007, this deferred credit balance was $478 and $408. Also, we may receive incentives based on a store's net sales; we recognize these incentives in the year that they are earned as a reduction... -

Page 42

... program benefits for Nordstrom Notes and alterations in cost of sales given that we provide customers with products or services for these rewards. Other costs of the loyalty program, which primarily include shipping and fashion events, are recorded as selling, general and administrative expenses... -

Page 43

... of the remaining portion of our Nordstrom private label and Nordstrom VISA credit card receivables and accrued finance charges not yet allocated to customer accounts. Other accounts receivable consist primarily of credit card receivables due from third-party financial institutions and vendor claims... -

Page 44

... increase to tax positions in current period Lapse of statute Settlements Unrecognized tax benefit at end of year 2008 $27 2 (1) 4 (1) (3) $28 2007 $21 5 (1) 3 (1) $27 Unrecognized tax benefits related to federal, state and foreign tax positions may decrease by $13 by January 30, 2010, if years... -

Page 45

... as follows: Compensation and benefits accruals Accrued expenses Merchandise inventories Land, buildings and equipment basis and depreciation differences Gift cards and gift certificates Loyalty reward certificates Allowance on accounts receivables Federal benefit of state taxes Other Total deferred... -

Page 46

...fair value of long-term debt, including current maturities, using quoted market prices of the same or similar issues, was $1,750 and $2,514 at the end of 2008 and 2007. Required principal payments on long-term debt, excluding capital lease obligations, are as follows: Fiscal year 2009 2010 2011 2012... -

Page 47

...the cost of commercial paper issued by the third-party bank conduit plus specified fees. NOTE 7: LEASES Future minimum lease payments as of January 31, 2009 are as follows: Fiscal year 2009 2010 2011 2012 2013 Thereafter Total minimum lease payments Less amount representing interest Present value of... -

Page 48

... at beginning of year Participant service cost Interest cost Benefits paid Actuarial gain Benefit obligation at end of year Change in plan assets: Fair value of plan assets at beginning of year Employer contribution Distributions Fair value of plan assets at end of year Underfunded status $95... -

Page 49

... follows: Fiscal year 2009 2010 2011 2012 2013 2014-2018 $5 5 5 6 6 37 In 2009, we expect less than $1 of costs currently in accumulated other comprehensive earnings to be recognized as components of net periodic benefit cost. We expect to make contributions to the plan of $5. Nordstrom, Inc. and... -

Page 50

... and inventory purchase orders were $1,059 as of January 31, 2009. In connection with the purchase of foreign merchandise, we have outstanding import letters of credit totaling $5 as of January 31, 2009. NOTE 12: SHAREHOLDERS' EQUITY AND STOCK COMPENSATION PLANS Share Repurchase Program 2008 SHARE... -

Page 51

...: Fiscal year Cost of sales and related buying and occupancy costs Selling, general and administrative expenses Total stock-based compensation expense before income tax benefit 2008 $10 18 $28 2007 $10 16 $26 2006 $12 25 $37 Statement of Financial Accounting Standard No. 123(R), Share-Based Payment... -

Page 52

... stock-based compensation expense on a straight-line basis over the requisite service period. A summary of the stock option activity for 2008 under the Nordstrom, Inc. Plans is presented below: Fiscal Year Shares Outstanding, beginning of year Granted Exercised Cancelled Outstanding, end of year... -

Page 53

... plan. NOTE 14: EARNINGS PER SHARE Earnings per basic share is computed using the weighted average number of common shares outstanding during the year. Earnings per diluted share uses the weighted average number of common shares outstanding during the year plus dilutive common stock equivalents... -

Page 54

... our online store and the catalog as opposed to in a retail store. As such, we aggregate our full-line and Rack stores into the Retail Stores segment and report Direct as a separate segment. The Credit segment earns finance charges and late fee income through operation of the Nordstrom private label... -

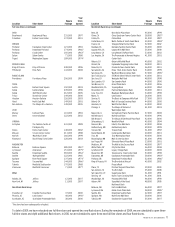

Page 55

... to Consolidated Financial Statements Dollar and share amounts in millions except per share and per option amounts The following tables set forth the information for our reportable segments: Fiscal year 2008 Net sales (a) Net sales (decrease) increase Credit card revenue Other income and expense... -

Page 56

... Financial Statements Dollar and share amounts in millions except per share and per option amounts NOTE 16: SELECTED QUARTERLY DATA (UNAUDITED) Fiscal year 2008 Net sales Same-store sales percentage change Credit card revenues Gross profit1 Selling, general and administrative expenses: Retail stores... -

Page 57

... as exhibits to each of our quarterly reports on Form 10-Q. Our President certified to the New York Stock Exchange (NYSE) on June 11, 2008 pursuant to Section 303A.12(a) of the NYSE's listing standards, that he was not aware of any violation by the Company of the NYSE's corporate governance listing... -

Page 58

... after the end of our fiscal year: Election of Directors Certain Relationships and Related Transactions Item 14. Principal Accounting Fees and Services. The information required under this item is included in the following section of our Proxy Statement for our 2009 Annual Meeting of Shareholders... -

Page 59

... to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. NORDSTROM, INC. (Registrant) Michael G. Koppel Michael G. Koppel Executive Vice President and... -

Page 60

... financial statement schedule of Nordstrom, Inc. and subsidiaries and the effectiveness of Nordstrom, Inc.'s internal control over financial reporting appearing in this Annual Report on Form 10-K of Nordstrom, Inc. for the year ended January 31, 2009. /s/ Deloitte & Touche LLP Seattle, Washington... -

Page 61

...ACCOUNTS (Dollars in millions) Column A Column B Balance at beginning of period Description Deducted from related consolidated balance sheet account Allowance for doubtful accounts: Year ended: January 31, 2009 February 2, 2008 February 3, 2007 Reserves Allowance for sales return, net: Year ended... -

Page 62

...Note purchase agreement, dated as of May 2, 2007, by and between Nordstrom Incorporated by reference from the Registrant's Quarterly Credit Card Receivables II LLC, Nordstrom fsb, Nordstrom Credit, Inc., Falcon Report on Form 10-Q for the quarter ended May 5, 2007, Asset Securitization Company, LLC... -

Page 63

... Report on Form 10-Q for the quarter ended October 29, 2005, Exhibit 10.1 10.9 10.10 Guaranty Agreement dated April 18, 2002 between Registrant, New York Life Insurance Company and Life Investors Insurance Company of America 10.11 The 2002 Nonemployee Director Stock Incentive Plan 10.12 Nordstrom... -

Page 64

...Operating Procedures dated Incorporated by reference from the Registrant's Annual August 30, 1991 between Registrant and Nordstrom National Credit Bank, dated Report on Form 10-K for the year ended February 2, 2008, May 1, 2007 Exhibit 10.37 10.34 Forms of Notice of 1999 Stock Option Grant and Stock... -

Page 65

... by reference from the Registrant's Quarterly May 13, 2008 Report on Form 10-Q for the quarter ended August 2, 2008, Exhibit 10.1 10.50 Nordstrom 401(k) Plan & Profit Sharing, amended and restated on August 27, 2008 10.51 Nordstrom, Inc. Employee Stock Purchase Plan, amended and restated on August... -

Page 66

...Form of Notice of 2000 Stock Option Grant and Stock Option Agreement under Incorporated by reference from the Registrant's Annual the Nordstrom, Inc. 1997 Equity Incentive Plan Report on Form 10-K for the year ended February 2, 2008, Exhibit 10.39 10.59 Form of 2005 Performance Share Unit Notice and...