NetZero 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 NetZero annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

credit are maintained by FTD to secure credit card processing activity and additional letters of credit are maintained related to inventory

purchases.

Other Commitments

In the ordinary course of business, we may provide indemnifications of varying scope and terms to customers, vendors, lessors, sureties and

insurance companies, business partners, and other parties with respect to certain matters, including, but not limited to, losses arising out of our

breach of such agreements, services to be provided by us, or from intellectual property infringement claims made by third parties. In addition, we

have entered into indemnification agreements with our directors and certain of our officers and employees that will require us, among other

things, to indemnify them against certain liabilities that may arise by reason of their status or service as directors, officers or employees. We

have also agreed to indemnify certain former officers, directors and employees of acquired companies in connection with the acquisition of such

companies. We maintain director and officer insurance, which may cover certain liabilities, including those arising from our obligation to

indemnify our directors and certain of our officers and employees, and former officers, directors and employees of acquired companies, in

certain circumstances.

It is not possible to determine the maximum potential amount of exposure under these indemnification agreements due to the limited history

of prior indemnification claims and the unique facts and circumstances involved in each particular agreement. Such indemnification agreements

may not be subject to maximum loss clauses.

Off-Balance Sheet Arrangements

At December 31, 2011, we had no off-balance sheet arrangements that have, or are reasonably likely to have, a current or future material

effect on our consolidated financial condition, results of operations, liquidity, capital expenditures, or capital resources.

Recent Accounting Pronouncements

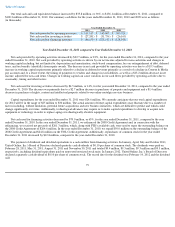

Comprehensive Income —In June 2011, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update

("ASU") No. 2011-05, Presentation of Comprehensive Income , as codified in ASC 220, Comprehensive Income . The amendments in this

update require that all non-owner changes in stockholders' equity be presented either in a single continuous statement of comprehensive income

or in two separate but consecutive statements. In the two-statement approach, the first statement should present total net income and its

components followed consecutively by a second statement that should present total other comprehensive income, the components of other

comprehensive income, and the total of comprehensive income. Additionally, the amendments in this update require that reclassification

adjustments from other comprehensive income to net income be shown on the face of the statement of comprehensive income. The amendments

in this update should be applied retrospectively and are effective for fiscal years, and interim periods within those years, beginning after

December 15, 2011. We do not expect this update to have a material impact on our consolidated financial statements. Additionally, in December

2011, FASB issued ASU No. 2011-12, Deferral of Effective Date for Amendments to the Presentation of Reclassifications of Items Out of

Accumulated Other Comprehensive Income in Accounting Standard Update No. 2011

-05 , as codified in ASC 220. The amendments in this

update supersede certain paragraphs in ASU No. 2011-05, to effectively defer only those changes in Update 2011-05 that relate to the

presentation of reclassification adjustments out of accumulated other comprehensive income. The amendments in this update are effective at the

same time as the amendments in Update 2011-05 so that entities will not be required to comply with the presentation requirements in Update

2011-05 that this Update is deferring. The amendments in this Update are effective for public entities for fiscal years, and interim periods within

those years,

83