NetZero 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 NetZero annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

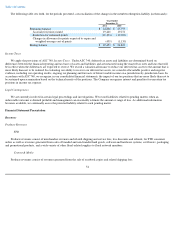

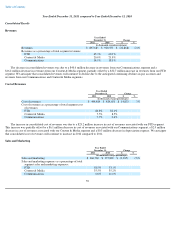

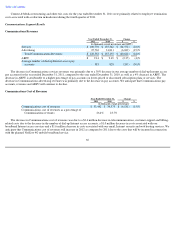

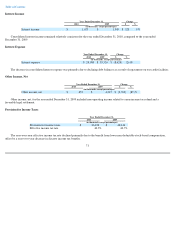

FTD Restructuring and Other Exit Costs

FTD restructuring and other exit costs for the year ended December 31, 2011 totaled $0.9 million and were associated with reductions in

headcount. Restructuring and other exit costs for the year ended December 31, 2010 totaled $1.6 million and primarily related to the closure of

certain call center facilities in the U.S. and the U.K.

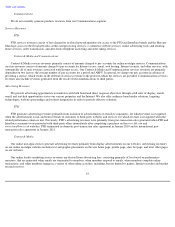

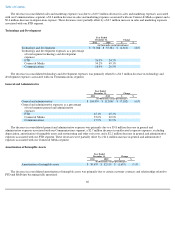

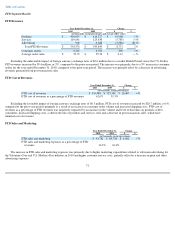

Content & Media Segment Results

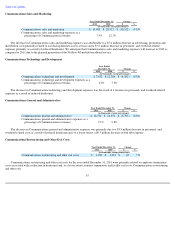

Content & Media Revenues

The decrease in Content & Media services revenues was a result of a 15% decrease in our average number of pay accounts for the year

ended December 31, 2011 compared to the year ended December 31, 2010, partially offset by a 9% increase in ARPU. The increase in ARPU

was primarily attributable to an overall decrease in the percentage of pay accounts on discounted plans and a higher percentage of domestic pay

accounts on shorter-term subscription plans, which have higher ARPUs. In addition, Content & Media advertising revenues decreased due to a

decrease in segment active accounts and a decrease in available inventory on the Classmates website as well as a decrease in advertising

revenues generated by our online loyalty marketing service due to a number of factors, including the loss of a major customer. These decreases

were partially offset by $0.9 million in products revenues generated in the year ended December 31, 2011. We anticipate that Content & Media

pay accounts and revenues will continue to decline.

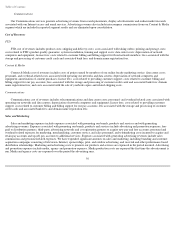

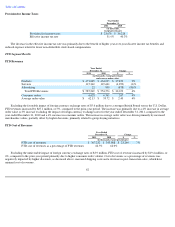

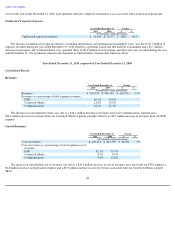

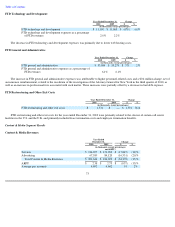

Content & Media Cost of Revenues

The decrease in Content & Media cost of revenues was primarily due to a $1.6 million decrease in personnel- and overhead-

related costs, an

$0.8 million decrease in bank fees and a $0.5 million decrease in the cost of points earned by members of our online loyalty marketing service.

64

Year Ended

December 31, Change

2011 2010 $ %

(in thousands, except percentages)

FTD restructuring and other exit costs

$

876

$

1,574

$

(698

)

(44

)%

Year Ended December 31, Change

2011

2010

$

%

(in thousands, except percentages and ARPU)

Products

$

864

$

—

$

864

N/A

Services

123,992

134,055

(10,063

)

(8

)%

Advertising

60,619

67,589

(6,970

)

(10

)%

Total Content & Media Revenues

$

185,475

$

201,644

$

(16,169

)

(8

)%

ARPU

$

2.59

$

2.38

$

0.21

9

%

Average pay accounts

3,992

4,693

(701

)

(15

)%

Year Ended December 31,

Change

2011

2010

$

%

(in thousands, except percentages)

Content & Media cost of revenues

$

32,575

$

35,514

$

(2,939

)

(8

)%

Content & Media cost of revenues as a percentage of

Content & Media revenues

17.6

%

17.6

%