NetZero 2011 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2011 NetZero annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

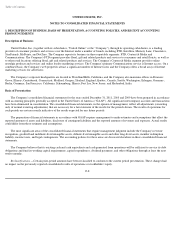

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. DESCRIPTION OF BUSINESS, BASIS OF PRESENTATION, ACCOUNTING POLICIES, AND RECENT ACCOUNTING

PRONOUNCEMENTS

Description of Business

United Online, Inc. (together with its subsidiaries, "United Online" or the "Company"), through its operating subsidiaries, is a leading

provider of consumer products and services over the Internet under a number of brands, including FTD, Interflora, Memory Lane, Classmates,

StayFriends, MyPoints, and NetZero. The Company reports its business in three reportable segments: FTD, Content & Media and

Communications. The Company's FTD segment provides floral, gift and related products and services to consumers and retail florists, as well as

to other retail locations offering floral, gift and related products and services. The Company's Content & Media segment provides online

nostalgia products and services and online loyalty marketing services. The Company's primary Communications service is Internet access. On a

combined basis, the Company's web properties attract a significant number of Internet users and the Company offers a broad array of Internet

marketing services for advertisers.

The Company's corporate headquarters are located in Woodland Hills, California, and the Company also maintains offices in Downers

Grove, Illinois; Centerbrook, Connecticut; Medford, Oregon; Sleaford, England; Quebec, Canada; Seattle, Washington; Erlangen, Germany;

Berlin, Germany; San Francisco, California; Schaumburg, Illinois; Fort Lee, New Jersey; and Hyderabad, India.

Basis of Presentation

The Company's consolidated financial statements for the years ended December 31, 2011, 2010 and 2009 have been prepared in accordance

with accounting principles generally accepted in the United States of America ("GAAP"). All significant intercompany accounts and transactions

have been eliminated in consolidation. The consolidated financial statements, in the opinion of management, reflect all adjustments (consisting

only of normal recurring adjustments) that are necessary for a fair statement of the results for the periods shown. The results of operations for

such periods are not necessarily indicative of the results expected for any future periods.

The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities, disclosure of contingent liabilities and the reported amounts of revenues and expenses. Actual results

could differ from these estimates and assumptions.

The most significant areas of the consolidated financial statements that require management judgment include the Company's revenue

recognition, goodwill and indefinite-lived intangible assets, definite-lived intangible assets and other long-lived assets, member redemption

liability, income taxes, and legal contingencies. The accounting policies for these areas are discussed elsewhere in these consolidated financial

statements.

The Company believes that its existing cash and cash equivalents and cash generated from operations will be sufficient to service its debt

obligations and fund its working capital requirements, capital expenditures, dividend payments, and other obligations through at least the next

twelve months.

Reclassifications —Certain prior-period amounts have been reclassified to conform to the current period presentation. These changes had

no impact on the previously reported consolidated results of operations or stockholders' equity.

F-8