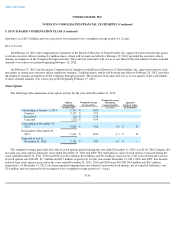

NetZero 2011 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2011 NetZero annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

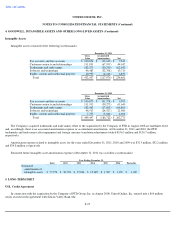

7. FAIR VALUE MEASUREMENTS (Continued)

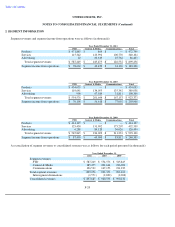

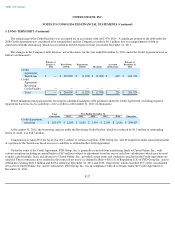

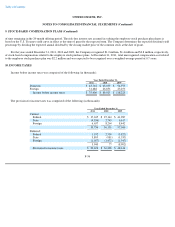

The following table presents information about assets at December 31, 2010 that were required to be measured at fair value on a recurring

basis (in thousands):

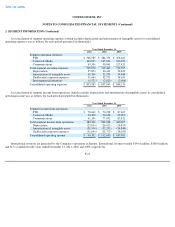

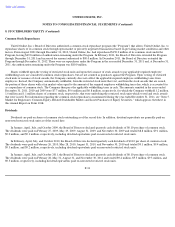

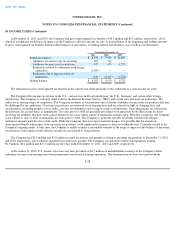

The Company estimated the fair value of its long-term debt using a discounted cash flow technique that incorporates a market interest yield

curve with adjustments for duration and risk profile. In determining the market interest yield curve, the Company considered, among other

factors, its estimate of its credit rating. The Company estimated its credit rating as BB+/BB- for the long-term debt associated with the Credit

Agreement, resulting in a discount rate of 6%. The table below summarizes the fair value estimates for long-term debt, net of discounts,

including the current portion, at December 31, 2011, as defined by ASC 825 (in thousands):

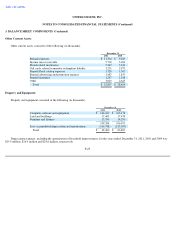

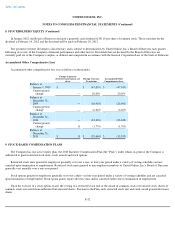

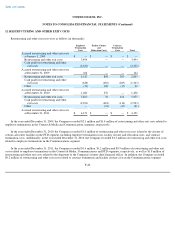

8. STOCKHOLDERS' EQUITY

Stockholder Rights Plan

On November 15, 2001, United Online, Inc.'s Board of Directors declared a dividend of one preferred share purchase right for each

outstanding share of common stock of United Online, Inc. (the "common stock"). The dividend was paid on November 26, 2001 to the

stockholders of record at the close of business on that date. Each right entitled the registered holder to purchase from United Online, Inc. one unit

consisting of one one-thousandth of a share of its Series A junior participating preferred stock at a price of $25 per unit. On April 29, 2003, the

Board of Directors voted to amend the purchase price per unit from $25 to $140. The rights generally were exercisable only if a person or group

acquired beneficial ownership of 15% or more of the common stock or announced a tender or exchange offer which would result in a person or

group owning 15% or more of the common stock. United Online, Inc. generally would have been entitled to redeem the rights at $0.0007 per

right at any time until 10 days after a public announcement that a 15% position in the common stock had been acquired or that a tender or

exchange offer which would result in a person or group owning 15% or more of the common stock had commenced. In February 2011, the

Board of Directors voted to accelerate the expiration date of the stockholder rights plan described above to February 28, 2011. Accordingly, on

February 28, 2011, such stockholder rights plan expired.

Preferred Stock

United Online, Inc. has 5.0 million shares of preferred stock authorized with a par value of $0.0001. At December 31, 2011 and 2010,

United Online, Inc. had no preferred shares issued or outstanding.

F-30

Description

Total Fair Value

Level 1 Fair Value

Money market funds

$

67,150

$

67,150

Carrying Amount

Estimated Fair Value

Long

-

term debt, net of discounts, including

current portion

$

261,124

$

256,174