NetZero 2011 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2011 NetZero annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

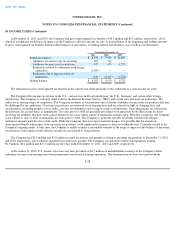

10. INCOME TAXES (Continued)

undistributed earnings is not practicable. The Company provided for U.S. income taxes on the earnings of its U.K. and German subsidiaries.

For the years ended December 31, 2011, 2010 and 2009, income tax shortfalls, net, attributable to equity-based compensation that were

allocated to stockholders' equity totaled $1.0 million, $1.0 million and $3.0 million, respectively.

At December 31, 2011, the Company had federal, state and foreign net operating loss carryforwards of $112.5 million, $43.2 million and

$7.1 million, respectively. The federal net operating loss carryforwards will begin to expire in 2018, the state net operating loss carryforwards

began expiring in 2009 and the foreign net operating loss carryforwards have an indefinite life. These carryforwards have been adjusted to reflect

the Company's estimate of limitations under Section 382 of the Internal Revenue Code of 1986, as amended.

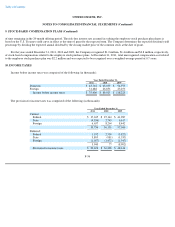

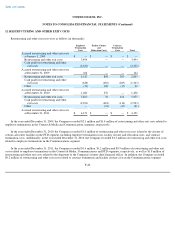

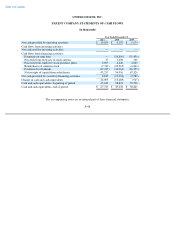

11. NET INCOME PER COMMON SHARE

The following table sets forth the computation of basic and diluted net income per common share (in thousands, except per share amounts):

The diluted net income per common share computations exclude stock options and restricted stock units which are antidilutive. Weighted-

average antidilutive shares for the years ended December 31, 2011, 2010 and 2009 were 4.4 million, 2.5 million and 5.2 million, respectively.

F-39

Year Ended December 31,

2011

2010

2009

Numerator:

Net income

$

51,730

$

53,687

$

70,085

Income allocated to participating securities

(1,993

)

(3,233

)

(4,647

)

Net income attributable to common

stockholders

$

49,737

$

50,454

$

65,438

Denominator:

Weighted

-

average common shares

88,478

86,429

83,698

Add: Dilutive effect of non

-

participating

securities

153

633

688

Shares used to calculate diluted net income per

common share

88,631

87,062

84,386

Basic net income per common share

$

0.56

$

0.58

$

0.78

Diluted net income per common share

$

0.56

$

0.58

$

0.78