NetZero 2011 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2011 NetZero annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

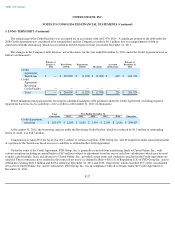

5. LONG-TERM DEBT (Continued)

The refinancing of the Credit Facilities was accounted for in accordance with ASC 470, Debt . A significant portion of the debt under the

2008 Credit Agreement was considered to be extinguished, and the Company recorded a $6.1 million loss on extinguishment of debt in

connection with the refinancing, which was recorded in interest expense for the year ended December 31, 2011.

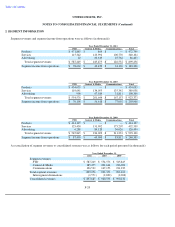

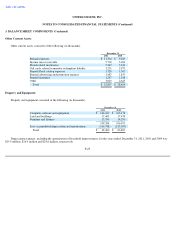

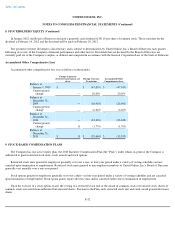

The changes in the Company's debt balances, net of discounts, for the year ended December 31, 2011 under the Credit Agreement were as

follows (in thousands):

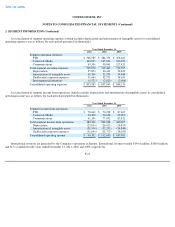

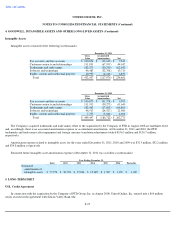

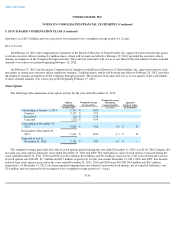

Future minimum principal payments based upon scheduled mandatory debt payments under the Credit Agreement, excluding required

repayments based on excess cash flows, were as follows at December 31, 2011 (in thousands):

At December 31, 2011, the borrowing capacity under the Revolving Credit Facility, which was reduced by $1.3 million in outstanding

letters of credit, was $48.7 million.

Commencing in April 2013 for fiscal year 2012, subject to certain exceptions, FTD Group, Inc. will be required to make annual repayments

of a portion of the Term Loan based on excess cash flow as defined in the Credit Agreement.

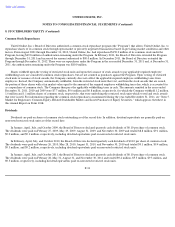

Under the terms of the Credit Agreement, FTD Group, Inc. is generally restricted from transferring funds to United Online, Inc., with

certain exceptions including an annual basket of $15 million (subject to adjustment based on excess cash flow calculations) which may be used

to make cash dividends, loans and advances to United Online, Inc., provided certain terms and conditions specified in the Credit Agreement are

satisfied. These restrictions have resulted in the restricted net assets (as defined in Rule 4-08(e)(3) of Regulation S-X) of FTD Group Inc. and its

subsidiaries totaling $262.1 million and $256.4 million at December 31, 2011 and 2010, respectively, which exceeded 25% of the consolidated

net assets of United Online, Inc. and its subsidiaries. FTD Group, Inc. was in compliance with all covenants under the Credit Agreement at

December 31, 2011.

F-27

Balance at

January 1,

2011 Draw Down

of Debt Repayments

of Debt Discounts Accretion

of Discounts

Balance at

December 31,

2011

Credit

Agreement,

Term Loan

$

—

$

265,000

$

(1,325

)

$

(2,780

)

$

229

$

261,124

Credit

Agreement,

Revolving

Credit Facility

—

—

—

—

—

—

Total

$

—

$

265,000

$

(1,325

)

$

(2,780

)

$

229

$

261,124

Year Ending December 31,

Total

Gross Debt

2012

2013

2014

2015

2016

Thereafter

Credit Agreement,

term loan

$

263,675

$

2,650

$

2,650

$

2,650

$

2,650

$

2,650

$

250,425