NetZero 2011 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2011 NetZero annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. DESCRIPTION OF BUSINESS, BASIS OF PRESENTATION, ACCOUNTING POLICIES, AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

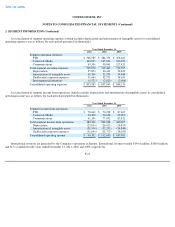

Foreign Currency Translation —The Company accounts for foreign currency translation in accordance with ASC 830, Foreign Currency

Matters

. The functional currency of each of the Company's international subsidiaries is its respective local currency. The financial statements of

these subsidiaries are translated to U.S. Dollars using period-end rates of exchange for assets and liabilities, and average rates of exchange for

the period for revenues and expenses. Translation gains and losses are recorded in accumulated other comprehensive loss as a component of

stockholders' equity in the consolidated balance sheets.

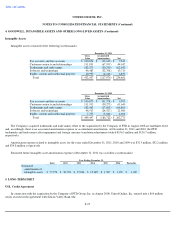

Income Taxes —The Company applies the provisions of ASC 740, Income Taxes . Under ASC 740, deferred tax assets and liabilities are

determined based on differences between the financial reporting and tax bases of assets and liabilities and are measured using the enacted tax

rates and laws that will be in effect when the differences are expected to reverse. The Company records a valuation allowance to reduce its

deferred tax assets to the amount that is more likely than not to be realized. In evaluating the Company's ability to recover its deferred tax assets,

the Company considers all available positive and negative evidence, including its operating results, ongoing tax planning and forecasts of future

taxable income on a jurisdiction-by-jurisdiction basis. In accordance with ASC 740, the Company recognizes, in its consolidated financial

statements, the impact of the Company's tax positions that are more likely than not to be sustained upon examination based on the technical

merits of the positions. The Company recognizes interest and penalties for uncertain tax positions in income tax expense.

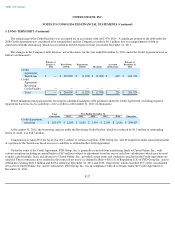

Earnings Per Share —The Company computes earnings per share in accordance with ASC 260, Earnings Per Share . ASC 260 provides

that unvested share-based payment awards that contain non-forfeitable rights to dividends are participating securities and shall be included in the

computation of earnings per share pursuant to the two-class method. The two-class method of computing earnings per share is an earnings

allocation formula that determines earnings per share for common stock and any participating securities according to dividends declared

(whether paid or unpaid) and participation rights in undistributed earnings. Certain of the Company's restricted stock units are considered

participating securities because they contain non-forfeitable rights to dividends irrespective of whether the awards ultimately vest.

Legal Contingencies —The Company is currently involved in certain legal proceedings and investigations. The Company records liabilities

related to pending matters when an unfavorable outcome is deemed probable and management can reasonably estimate the amount or range of

loss. As additional information becomes available, the Company continually assesses the potential liability related to such pending matter.

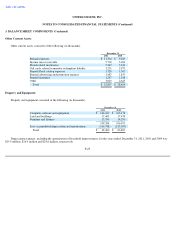

Operating Leases —The Company leases office space, data centers, vehicles, and certain office equipment under operating lease

agreements with original lease periods of up to ten years. Certain of the lease agreements contain rent holidays and rent escalation provisions.

Rent holidays and rent escalation provisions are considered in determining straight-line rent expense to be recorded over the lease term. The

lease term begins on the date of initial possession of the leased property for purposes of recognizing lease expense on a straight-line basis over

the term of the lease.

F-18