NetZero 2011 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2011 NetZero annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. INCOME TAXES (Continued)

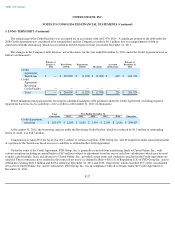

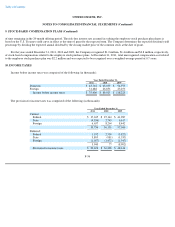

The provision for income taxes reconciled to the amount computed by applying the statutory federal rate to income before taxes as follows

(in thousands):

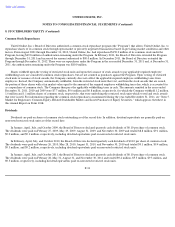

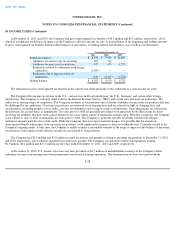

The significant components of net deferred tax balances were as follows (in thousands):

The Company had a valuation allowance of $8.8 million and $7.5 million at December 31, 2011 and 2010, respectively, to reduce deferred

tax assets to an amount that is more likely than not to be realized in future periods. The valuation allowance relates primarily to net operating

losses and foreign tax credits.

F-37

Year Ended December 31,

2011

2010

2009

Federal taxes at statutory rate of 35%

$

26,392

$

31,470

$

41,380

State taxes, net

1,662

2,846

3,493

Nondeductible executive compensation

1,992

3,873

6,377

Effects of foreign income

(3,300

)

(3,321

)

(2,706

)

Foreign distribution

9,890

9,636

8,127

Foreign tax credit

(7,869

)

(6,807

)

(5,871

)

Changes in uncertain tax positions

(3,732

)

(1,448

)

(2,669

)

Other differences, net

(1,359

)

(21

)

13

Provision for income taxes

$

23,676

$

36,228

$

48,144

December 31,

2011

2010

Deferred tax assets:

Net operating loss and foreign tax credit carryforwards

$

51,046

$

54,051

Stock

-

based compensation

3,212

3,156

Other, net

13,781

11,153

Total gross deferred tax assets

68,039

68,360

Less: valuation allowance

(8,777

)

(7,510

)

Total deferred tax assets after valuation allowance

59,262

60,850

Deferred tax liabilities:

Amortization of acquired intangible assets

(76,069

)

(84,039

)

Depreciation and amortization

(11,704

)

(5,288

)

Total deferred tax liabilities

(87,773

)

(89,327

)

Net deferred tax liabilities

$

(28,511

)

$

(28,477

)

December 31,

2011 2010

Current deferred tax assets, net

$

15,587

$

14,200

Non

-

current deferred tax liabilities, net

(44,098

)

(42,677

)

Net deferred tax liabilities

$

(28,511

)

$

(28,477

)