NetZero 2011 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2011 NetZero annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

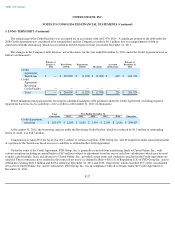

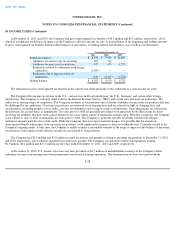

9. STOCK-BASED COMPENSATION PLANS (Continued)

forfeitures, was $15.5 million and was expected to be recognized over a weighted-average period of 1.2 years.

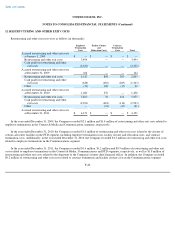

Recent Awards

On February 23, 2012, the Compensation Committee of the Board of Directors of United Online, Inc. approved restricted stock unit grants

to certain executive officers totaling 0.4 million shares, which will be made and effective February 29, 2012, provided the executive officer

remains an employee of the Company through such date. The restricted stock units will vest as to one-third of the total number of units awarded

annually over a three-year period beginning February 15, 2012.

On February 27, 2012, the Secondary Compensation Committee of the Board of Directors of United Online, Inc. approved restricted stock

unit grants to certain non-executive officer employees totaling 1.3 million shares, which will be made and effective February 29, 2012, provided

the employee remains an employee of the Company through such date. The restricted stock units will vest as to one-quarter of the total number

of units awarded annually over a four-year period beginning February 15, 2012.

Stock Options

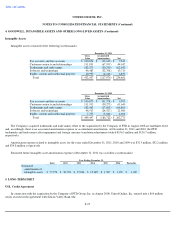

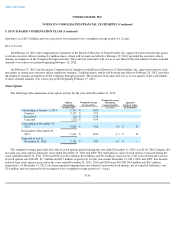

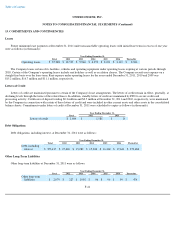

The following table summarizes stock option activity for the year ended December 31, 2011:

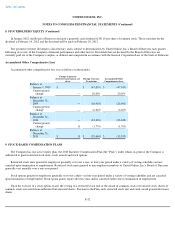

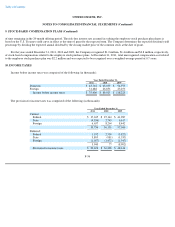

The weighted-

average grant date fair value of stock options granted during the year ended December 31, 2011 was $1.96. The Company did

not grant any stock options during the years ended December 31, 2010 and 2009. The total intrinsic value of stock options exercised during the

years ended December 31, 2011, 2010 and 2009 was $0.1 million, $2.0 million, and $0.3 million, respectively. Cash received from the exercise

of stock options was $38,000, $1.7 million and $0.5 million, respectively, for the years ended December 31, 2011, 2010 and 2009. Tax benefits

realized from stock options exercised in the years ended December 31, 2011, 2010 and 2009 were $19,000, $0.8 million and $0.1 million,

respectively. At December 31, 2011, total unrecognized compensation cost related to nonvested stock options, net of expected forfeitures, was

$3.0 million and was expected to be recognized over a weighted-average period of 1.1 years.

F-34

Options

Outstanding Weighted-Average

Exercise Price

Weighted-Average

Remaining

Contractual Life Aggregate

Intrinsic Value

(in thousands)

(in years)

(in thousands)

Outstanding at January 1, 2011

1,714

$

8.82

Granted

2,375

$

7.05

Exercised

(21

)

$

1.78

Canceled

(252

)

$

9.94

Outstanding at December 31,

2011

3,816

$

7.68

5.8

$

12

Exercisable at December 31,

2011

1,641

$

8.52

1.3

$

12

Expected to vest at

December 31, 2011

2,126

$

7.05

9.1

$

—