NetZero 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 NetZero annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

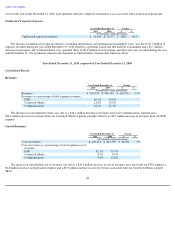

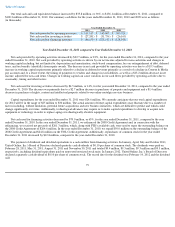

Liquidity and Capital Resources

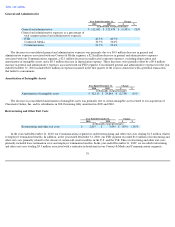

In connection with the FTD acquisition in August 2008, United Online, Inc. entered into a $60 million senior secured credit agreement with

Silicon Valley Bank (the "UOL Credit Agreement") and borrowed $60 million thereunder. The net proceeds of the term loan under the UOL

Credit Agreement were used to finance, in part, the acquisition of FTD. In April 2010, United Online, Inc. paid $14.7 million to retire this credit

facility.

In connection with the FTD acquisition in August 2008, UNOLA Corp., which was then an indirect wholly-owned subsidiary of United

Online, Inc., and which subsequently merged into FTD Group, Inc., entered into a $425 million senior secured credit agreement with Wells

Fargo Bank, National Association, as Administrative Agent (the "2008 Credit Agreement"), consisting of (i) a term loan A facility of

$75 million, (ii) a term loan B facility of $300 million, and (iii) a revolving credit facility of up to $50 million. On June 10, 2011, FTD

Group, Inc. entered into a new credit agreement (the "Credit Agreement") with Wells Fargo Bank, National Association, as Administrative

Agent for the lenders, to refinance the 2008 Credit Agreement. The Credit Agreement provides FTD Group, Inc. with a $315 million senior

secured credit facility consisting of (i) a $265 million seven-year term loan (the "Term Loan") and (ii) a $50 million five-year revolving credit

facility (the "Revolving Credit Facility" and together with the Term Loan, the "Credit Facilities"), and certain other financial accommodations,

including letters of credit.

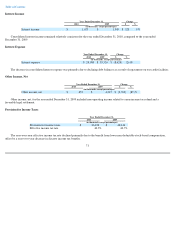

On June 10, 2011, FTD Group, Inc. repaid in full all outstanding indebtedness under the 2008 Credit Agreement. No penalties were paid in

connection with such repayment. The repayment of obligations under the 2008 Credit Agreement was financed with the proceeds of the

$265 million of term loan borrowings under the Credit Agreement and FTD's available cash. No funds were borrowed under the Revolving

Credit Facility at closing.

The obligations under the Credit Agreement are guaranteed by FTD's parent, UNOL Intermediate, Inc. ("Holdings"), and certain of the

wholly-owned domestic subsidiaries of FTD Group, Inc. (the "Subsidiary Guarantors"). In addition, the obligations under the Credit Agreement

are secured by a lien on substantially all of the assets of FTD Group, Inc., Holdings and the Subsidiary Guarantors (collectively, the "Loan

Parties"), including a pledge of all (except with respect to foreign subsidiaries, in which case such pledges are limited to 66%) of the outstanding

capital stock of certain direct subsidiaries of the Loan Parties.

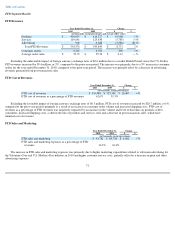

The interest rates on both the Term Loan and the Revolving Credit Facility are either a base rate plus 2.5% per annum, or LIBOR plus 3.5%

per annum (with a LIBOR floor of 1.25% in the case of the Term Loan and step downs in the LIBOR margin on the Revolving Credit Facility

depending on FTD's net leverage ratio). In addition, there is a commitment fee equal to 0.50% per annum (with step-downs in the commitment

fee depending on FTD's net leverage ratio) on the unused portion of the Revolving Credit Facility. The Credit Agreement contains customary

representations and warranties, events of default, affirmative covenants, and negative covenants, that require, among other things, FTD to

maintain compliance with a maximum net leverage ratio and a minimum fixed-charge coverage ratio, and impose restrictions and limitations on,

among other things, capital expenditures, investments, dividends, asset sales, and incurrence of additional debt or liens by Holdings, FTD

Group, Inc. and their subsidiaries. The Credit Agreement also provides for an additional $100 million in borrowing, subject to certain conditions,

including compliance with covenants and approval by the lender group.

78