NetZero 2011 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2011 NetZero annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

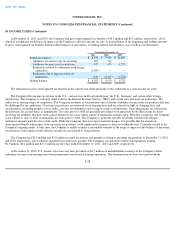

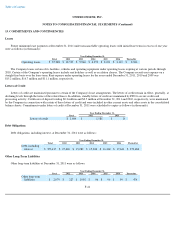

13. COMMITMENTS AND CONTINGENCIES (Continued)

Attorney General for the State of Washington regarding certain post-transaction sales practices in which it had previously

engaged with certain third-party vendors.

The Company cannot predict the outcome of these or any other governmental investigations or other legal actions or their potential

implications for its business. There are no assurances that additional governmental investigations or other legal actions will not be instituted in

connection with the Company's former post-transaction sales practices or other current or former business practices.

The Company records a liability when it believes that it is both probable that a loss will be incurred, and the amount of loss can be

reasonably estimated. The Company evaluates, at least quarterly, developments in its legal matters that could affect the amount of liability that

has been previously accrued, and makes adjustments as appropriate. Significant judgment is required to determine both probability and the

estimated amount. The Company may be unable to estimate a possible loss or range of possible loss due to various reasons, including, among

others: (i) if the damages sought are indeterminate; (ii) if the proceedings are in early stages, (iii) if there is uncertainty as to the outcome of

pending appeals, motions or settlements, (iv) if there are significant factual issues to be determined or resolved, and (v) if there are novel or

unsettled legal theories presented. In such instances, there is considerable uncertainty regarding the ultimate resolution of such matters, including

a possible eventual loss, if any. At December 31, 2011, the Company had reserves of $4.8 million for pending legal settlements. With respect to

the other legal matters described above, the Company had determined, based on its current knowledge, that the amount of possible loss or range

of loss, including any reasonably possible losses in excess of amounts already accrued, is not reasonably estimable. However, legal matters are

inherently unpredictable and subject to significant uncertainties, some of which are beyond the Company's control. As such, there can be no

assurance that the final outcome of these matters will not materially and adversely affect the Company's business, financial condition, results of

operations, or cash flows.

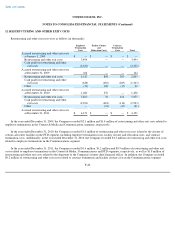

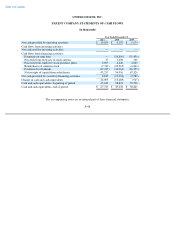

14. QUARTERLY FINANCIAL DATA (UNAUDITED) (in thousands, except per share data)

F-44

Quarter Ended

December 31

September 30

June 30

March 31

Year ended December 31, 2011:

Revenues

$

217,921

$

182,694

$

255,565

$

241,505

Cost of revenues

$

108,915

$

82,801

$

131,942

$

120,826

Operating income

$

23,674

$

20,223

$

27,789

$

22,616

Net income

$

12,865

$

11,916

$

14,768

$

12,181

Net income attributable to common

stockholders

$

12,473

$

11,449

$

14,191

$

11,626

Basic net income per common share

$

0.14

$

0.13

$

0.16

$

0.13

Diluted net income per common share

$

0.14

$

0.13

$

0.16

$

0.13