NetZero 2011 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2011 NetZero annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. DESCRIPTION OF BUSINESS, BASIS OF PRESENTATION, ACCOUNTING POLICIES, AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

expenses include media, agency and promotion expenses. Media production costs are expensed the first time the advertisement is run. Media and

agency costs are expensed over the period the advertising runs. Advertising and promotion expenses for the years ended December 31, 2011,

2010 and 2009 were $96.7 million, $96.9 million and $120.0 million, respectively. At December 31, 2011 and 2010, $1.5 million and

$1.9 million, respectively, of prepaid advertising and promotion expenses were included in other current assets in the consolidated

balance sheets.

Technology and Development —

Technology and development expenses include expenses for product development, maintenance of existing

software and technology and the development of new or improved software and technology, including personnel-related expenses for the

Company's technology group in various office locations. Costs incurred by the Company to manage and monitor the Company's technology and

development activities are expensed as incurred. Costs relating to the acquisition and development of internal-use software are capitalized when

appropriate and depreciated over their estimated useful lives, generally three to five years.

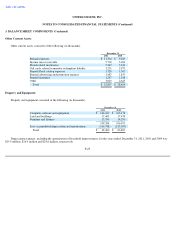

Software Development Costs —The Company accounts for costs incurred to develop software for internal use in accordance with ASC 350,

which requires such costs be capitalized and amortized over the estimated useful life of the software. The Company capitalizes costs associated

with customized internal-use software systems that have reached the application development stage. Such capitalized costs include external

direct costs utilized in developing or obtaining the applications and payroll and payroll-related expenses for employees who are directly

associated with the applications. Capitalization of such costs begins when the preliminary project stage is complete and ceases at the point in

which the project is substantially complete and ready for its intended purpose. The Company capitalized costs associated with internal-use

software totaling $12.8 million and $9.2 million in the years ended December 31, 2011 and 2010, respectively, which are being depreciated on a

straight-line basis over each project's estimated useful life, which is generally three years. Capitalized internal-use software is included in the

computer software and equipment category within property and equipment, net, in the consolidated balance sheets.

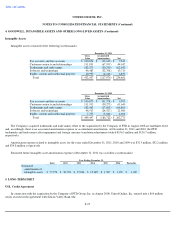

Software to be Sold, Leased or Marketed —The Company follows the provisions of ASC 985, which requires that all costs relating to the

purchase or internal development and production of computer software products to be sold, leased or otherwise marketed be expensed in the

period incurred unless the requirements for technological feasibility have been established. The Company capitalizes all eligible computer

software costs incurred once technological feasibility is established. The Company amortizes these costs using either the straight-line method

over a period of three to five years or the revenue method prescribed by ASC 985. At December 31, 2011 and 2010, the net book value of

capitalized computer software costs related to the internal development and production of computer software to be sold, leased or otherwise

marketed was $6.6 million and $9.5 million, respectively. During the years ended December 31, 2011, 2010 and 2009, the Company amortized

and recognized the associated depreciation expense of $10.9 million, $7.1 million and $3.7 million, respectively, related to these capitalized

computer software costs.

General and Administrative —General and administrative expenses, which include unallocated corporate expenses, consist of personnel-

related expenses for executive, finance, legal, human resources, facilities, internal audit, investor relations, internal customer support personnel,

and personnel

F-16