NetFlix 2005 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2005 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share and per share data and percentages)

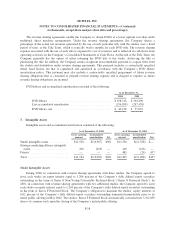

Provision for (benefit from) income taxes differed from the amounts computed by applying the U.S. federal

income tax rate of 35 percent to pretax income as a result of the following:

Year Ended December 31,

2003 2004 2005

Expected tax expense at U.S. federal statutory rate

of35% ...................................... $2,214 $ 7,404 $ 2,917

State income taxes, net of Federal income tax effect ..... — 28 377

Valuation allowance .............................. (5,914) (3,816) (35,596)

Stock-based compensation ......................... 3,644 (3,471) (1,433)

Other .......................................... 56 36 43

Provision for (benefit from) income taxes ............. $ — $ 181 $(33,692)

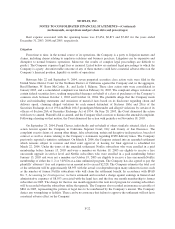

The tax effects of temporary differences and tax carryforwards that give rise to significant portions of the

deferred tax assets and liabilities are presented below:

Year Ended December 31,

2004 2005

Deferred tax assets:

Net operating loss carryforwards ......................... $30,491 $ 9,905

Accruals and reserves ................................. 853 3,880

Depreciation ......................................... 843 10,841

Stock-based compensation .............................. 6,978 9,728

Other .............................................. 14 647

Gross deferred tax assets ................................... 39,179 35,001

Valuation allowance against deferred tax assets ................. (39,179) (96)

Net deferred tax assets ..................................... $ — $34,905

The total valuation allowance for the years ended December 31, 2004 and 2005 decreased by $5,671 and

$39,083, respectively.

The Company continuously monitors the circumstances impacting the expected realization of its deferred

tax assets. As of December 31, 2004, the Company’s deferred tax assets were offset in full by a valuation

allowance because of its history of losses, limited profitable quarters to date and the competitive landscape of

online DVD rentals. As a result of the Company’s analysis of expected future income at December 31, 2005, it

was considered more likely than not that substantially all deferred tax assets would be realized, resulting in the

release of the previously recorded valuation allowance, and generating a $34,905 tax benefit. In evaluating its

ability to realize the deferred tax assets, the Company considered all available positive and negative evidence,

including its past operating results and the forecast of future market growth, forecasted earnings, future taxable

income, and prudent and feasible tax planning strategies. The remaining valuation allowance is related to capital

losses which can only be offset against future capital gains.

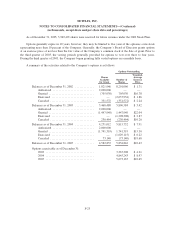

As of December 31, 2005, the Company had net operating loss carryforwards for federal tax purposes of

approximately $27 million, excluding approximately $65 million attributable to excess tax deductions related to

stock options, the benefit of which will be credited to equity when realized. The federal net operating loss

carryforwards will expire from 2019 to 2025, if not previously utilized.

F-28