NetFlix 2005 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2005 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

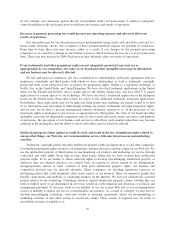

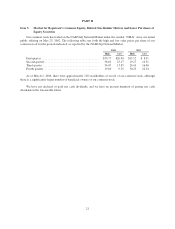

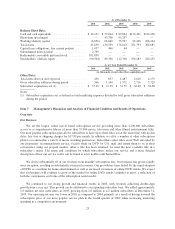

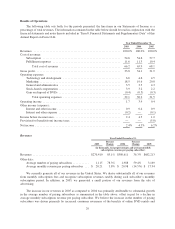

Item 6. Selected Financial Data

The following selected financial data is not necessarily indicative of results of future operations and should

be read in conjunction with “Item 7. Management’s Discussion and Analysis of Financial Condition and Results

of Operations” and “Item 8. Financial Statements and Supplementary Data.”

Year ended December 31,

2001 (1) 2002 (1) 2003 (1) 2004 (1) 2005 (2)

(in thousands, except per share data)

Statement of Operations Data:

Revenues .................................... $74,255 $150,818 $270,410 $500,611 $682,213

Cost of revenues:

Subscription ............................. 49,088 77,044 147,736 273,401 393,788

Fulfillment expenses ....................... 13,452 19,366 31,274 56,609 70,762

Total cost of revenues .................. 62,540 96,410 179,010 330,010 464,550

Gross profit .................................. 11,715 54,408 91,400 170,601 217,663

Operating expenses:

Technology and development ................ 17,734 14,625 17,884 22,906 30,942

Marketing ............................... 21,031 35,783 49,949 98,027 141,997

General and administrative .................. 4,658 6,737 9,585 16,287 29,395

Restructuring charges ...................... 671 ————

Stock-based compensation .................. 6,250 8,832 10,719 16,587 14,327

Gain on disposal of DVDs .................. (838) (896) (1,209) (2,560) (1,987)

Total operating expenses ................ 49,506 65,081 86,928 151,247 214,674

Operating income (loss). ........................ (37,791) (10,673) 4,472 19,354 2,989

Other income (expense):

Interest and other income ................... 461 1,697 2,457 2,592 5,753

Interest and other expense ................... (1,852) (11,972) (417) (170) (407)

Income (loss) before income taxes ................ (39,182) (20,948) 6,512 21,776 8,335

Provision for (benefit from) income taxes .......... — — — 181 (33,692)

Net income .................................. $(39,182) $ (20,948) $ 6,512 $ 21,595 $ 42,027

Net income (loss) per share (3):

Basic ................................... $ (10.73) $ (0.74) $ 0.14 $ 0.42 $ 0.79

Diluted .................................. $ (10.73) $ (0.74) $ 0.10 $ 0.33 $ 0.64

Weighted-average shares outstanding:

Basic ................................... 3,652 28,204 47,786 51,988 53,528

Diluted .................................. 3,652 28,204 62,884 64,713 65,518

Notes:

(1) Prior periods have been reclassified to conform to current period presentation (see Note 1 to Notes to

Consolidated Financial Statements).

(2) Net income for the year includes a benefit of realized deferred tax assets of $34,905 or approximately $0.53

per diluted share, related to the recognition of the Company’s deferred tax assets (See Note 9 to Notes to

Consolidated Financial Statements). In addition, general and administrative expenses includes an accrual of

$8.1 million (net of expected insurance proceeds for reimbursement of legal defense costs of $0.9 million)

related to the proposed settlement costs of the Chavez vs. Netflix, Inc. lawsuit (see Note 6 of Notes to

Consolidated Financial Statements).

(3) On January 16, 2004, the Company’s Board of Directors approved a two-for-one stock split in the form of a

stock dividend on all outstanding shares of the Company’s common stock. All common share and per-share

amounts have been retroactively adjusted to reflect the stock split for all years presented.

22