NetFlix 2005 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2005 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

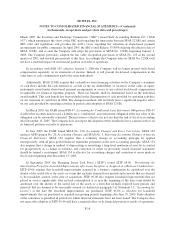

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share and per share data and percentages)

Stock-Based Compensation

Prior to the second quarter of 2003, the Company accounted for its stock-based employee compensation

plans using the intrinsic-value method. During the second quarter of 2003, the Company adopted the fair value

recognition provisions of SFAS No. 123, Accounting for Stock-Based Compensation, as amended by SFAS

No. 148, Accounting for Stock-Based Compensation—Transition and Disclosure, an Amendment of FASB

Statement No. 123, for all stock-based compensation. The Company elected to apply the retroactive restatement

method under SFAS No. 148 and all prior periods presented were restated to reflect the compensation costs that

would have been recognized had the fair value recognition provisions of SFAS No. 123 been applied to all

awards granted.

Segment Reporting

The Company is an online movie rental subscription service and substantially all of its revenues are derived

from monthly subscription fees. In the third quarter of 2004, the Company prepared to launch its online movie

subscription service in the United Kingdom. However, in October 2004, the Company announced its withdrawal

from the United Kingdom so that it could focus on defending its market leadership position in the United States.

As a result of the measures it undertook to prepare for the launch of its online subscription service in the

United Kingdom, the Company reorganized its business in the third quarter of 2004 into two geographical

segments: United States and International. In the fourth quarter of 2004, due to the Company’s decision to focus

its resources on defending its market leadership position in the United States and to postpone its expansion into

the United Kingdom market, the Company reverted to having a single operating segment. Accordingly, as of

December 31, 2004 and 2005, the Company was organized in a single operating segment for purposes of making

operating decisions and assessing performance in accordance with SFAS No. 131, Disclosures about Segments of

an Enterprise and Related Information. As a result, the net loss of $4,626 incurred in its ‘International’ segment

in 2004 is included within the operating results of the United States segment for 2004. The Company’s Chief

Executive Officer, who is the chief operating decision maker as defined in SFAS No. 131, evaluates

performance, makes operating decisions and allocates resources based on financial data consistent with the

presentation in the accompanying financial statements.

In conjunction with the closure of its operations in the United Kingdom, the Company incurred charges of

approximately $857 in 2004 related to the severance and benefits for the termination of employees and estimated

future obligations for non-cancelable lease payments for its facilities in the United Kingdom. The expenses

associated with the closure were included in fulfillment, marketing and general and administrative expenses in

the Consolidated Statements of Income for 2004. As of December 31, 2004, the remaining obligations of $366

were reflected in accrued expenses in the Consolidated Balance Sheet. There were no remaining obligations at

December 31, 2005.

Recent Accounting Pronouncements

In December 2004, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial

Accounting Standards (“SFAS”) No. 123(R), Share-Based Payment, which establishes standards for transactions

in which an entity exchanges its equity instruments for goods or services. This standard replaces SFAS No. 123,

Accounting for Stock-Based Compensation and supersedes APB Opinion No. 25, Accounting for Stock Issued to

Employees. This Standard requires a public entity to measure the cost of employee services received in exchange

for an award of equity instruments based on the grant-date fair value of the award. This eliminates the exception

to account for such awards using the intrinsic method previously allowable under APB Opinion No. 25. In

F-15