NetFlix 2005 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2005 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.to be a better indicator of expected volatility than historical volatility of our common stock. Therefore,

we revised the volatility factor used to estimate the fair value of stock-based compensation awards

beginning in the second quarter of 2005 to be based on a blend of historical volatility of our common

stock and implied volatility of tradable forward call options to purchase shares of our common stock.

Prior to the second quarter of 2005, we estimated expected volatility based on historical volatility of our

common stock over the most recent period commensurate with the estimated expected life of our stock

options.

•Expected Life: Prior to the third quarter of 2003, we granted stock options, which generally vested

over three to four-year periods. Since the third quarter of 2003, we began granting fully vested stock

options to our employees on a monthly basis. As a result, we changed the expected life from 3.5 years to

1.5 years. In the second quarter of 2004, we revised our estimate of expected life based on our review of

historical patterns for exercises of stock options. We bifurcated our option grants into two employee

groupings (executive and non-executive) based on exercise behavior and changed the estimate of the

expected life from 1.5 years for all option grants in the first quarter of 2004 to 2.5 years for one group

and 1 year for the other group beginning in the second quarter of 2004. In the second quarter of 2005, in

light of the guidance in SAB 107, we further refined our estimate of expected life for option grants to 4

years for one group and 3 years for the other group from 2.5 years and 1 year, respectively. In

determining the estimate, we considered several factors, including the historical option exercise

behavior of our employees and the terms and vesting periods of the options granted. We shall continue

to monitor the assumptions used to measure stock-based compensation.

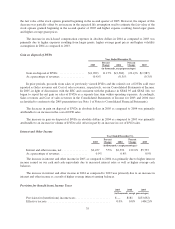

Income Taxes

We record a tax provision for the anticipated tax consequences of our reported results of operations. In

accordance with SFAS No. 109, Accounting for Income Taxes, the provision for income taxes is computed using

the asset and liability method, under which deferred tax assets and liabilities are recognized for the expected

future tax consequences of temporary differences between the financial reporting and tax bases of assets and

liabilities, and for operating loss carryforwards. Deferred tax assets and liabilities are measured using the

currently enacted tax rates that apply to taxable income in effect for the years in which those tax assets are

expected to be realized or settled. We record a valuation allowance to reduce deferred tax assets to the amount

that is believed more likely than not to be realized.

As of December 31, 2004, our deferred tax assets, primarily the tax benefits of loss carryforwards, were

offset in full by a valuation allowance because of our history of losses through the first quarter of 2003, limited

profitable quarters to date and the competitive landscape of online DVD rentals. As a result of our analysis of

expected future income at December 31, 2005, it was considered more likely than not that a valuation allowance

for deferred tax assets was no longer required resulting in the release of a previously recorded allowance

generating a $34.9 million tax benefit. Deferred tax assets do not include the tax benefits attributable to

approximately $65 million of excess tax deductions related to stock options. These benefits will only be recorded

when realized on tax returns and will be credited to equity at that time.

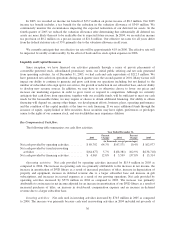

In evaluating our ability to recover our deferred tax assets, in full or in part, we consider all available

positive and negative evidence, including our past operating results, the existence of cumulative losses in the

most recent fiscal years and our forecast of future market growth, forecasted earnings, future taxable income, the

mix of earnings in the jurisdictions in which we operate and prudent and feasible tax planning strategies. The

assumptions utilized in determining future taxable income require significant judgment and are consistent with

the plans and estimates we are using to manage the underlying businesses. We believe that the deferred tax assets

recorded on our balance sheet will ultimately be realized. In the event we were to determine that we would not be

able to realize all or part of our net deferred tax assets in the future, an adjustment to the deferred tax assets

would be charged to earnings in the period in which we make such determination.

26