NetFlix 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

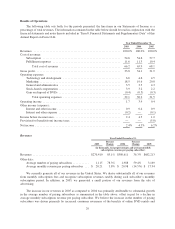

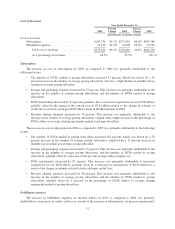

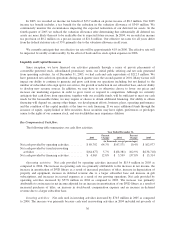

General and Administrative

Year Ended December 31,

2003

Percent

Change 2004

Percent

Change 2005

(in thousands, except percentages)

General and administrative ................. $9,585 69.9% $16,287 80.5% $29,395

As a percentage of revenues ................ 3.5% 3.3% 4.3%

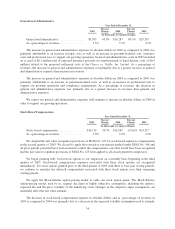

The increase in general and administrative expenses in absolute dollars in 2005 as compared to 2004 was

primarily attributable to an increase in legal costs as well as an increase in personnel-related costs, insurance

costs and professional fees, to support our growing operations. General and administrative costs in 2005 included

an accrual of $8.1 million (net of expected insurance proceeds for reimbursement of legal defense costs of $0.9

million) related to the proposed settlement costs of the Chavez vs. Netflix, Inc. lawsuit. As a percentage of

revenues, the increase in general and administrative expenses was primarily due to a greater increase in general

and administrative expenses than increase in revenues.

The increase in general and administrative expenses in absolute dollars in 2004 as compared to 2003 was

primarily attributable to an increase in personnel-related costs, as well as an increase in professional fees to

support our growing operations and compliance requirements. As a percentage of revenues, the decrease in

general and administrative expenses was primarily due to a greater increase in revenues than general and

administrative expenses.

We expect our general and administrative expenses will continue to increase in absolute dollars in 2006 in

order to support our growing operations.

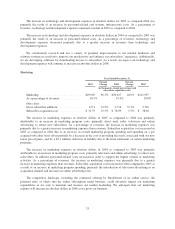

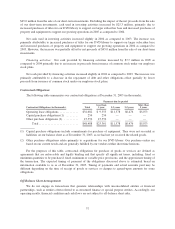

Stock-Based Compensation

Year Ended December 31,

2003

Percent

Change 2004

Percent

Change 2005

(in thousands, except percentages)

Stock-based compensation ................ $10,719 54.7% $16,587 (13.6)% $14,327

As a percentage of revenues ............... 3.9% 3.2% 2.2%

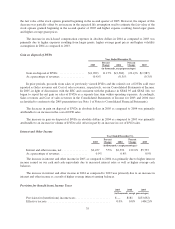

We adopted the fair value recognition provisions of SFAS No. 123 for stock-based employee compensation

in the second quarter of 2003. We elected to apply the retroactive restatement method under SFAS No. 148 and

all prior periods presented have been restated to reflect the compensation costs that would have been recognized

had the fair value recognition provisions of SFAS No. 123 been applied to all awards granted to employees.

We began granting fully vested stock options to our employees on a monthly basis beginning in the third

quarter of 2003. Stock-based compensation expenses associated with these stock options are recognized

immediately. For stock options granted prior to the third quarter of 2003 with three to four-year vesting periods,

we continue to amortize the deferred compensation associated with these stock options over their remaining

vesting periods.

We apply the Black-Scholes option-pricing model to value our stock option grants. The Black-Scholes

option-pricing model, used by us, requires the input of highly subjective assumptions, including the option’s

expected life and the price volatility of the underlying stock. Changes in the subjective input assumptions can

materially affect the fair value estimate.

The decrease in stock-based compensation expense in absolute dollars and as a percentage of revenues in

2005 as compared to 2004 was primarily due to a decrease in the expected volatility assumption used to estimate

34