NetFlix 2005 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2005 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Descriptions of Statement of Income Components

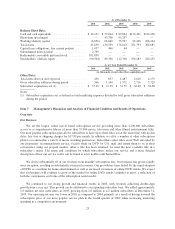

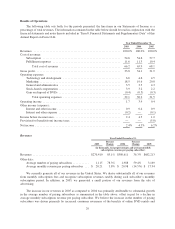

Revenues:

Revenues include subscription revenues and, for 2005, revenues from the sale of advertising, which were

not material. We generate all our subscription revenues in the United States. We derive substantially all of our

revenues from monthly subscription fees and recognize subscription revenues ratably over each subscriber’s

monthly subscription period. We record refunds to subscribers as a reduction of revenues. In addition to our most

popular service of $17.99 per month, we offer other service plans with different price points that allow

subscribers to keep either fewer or more titles at the same time.

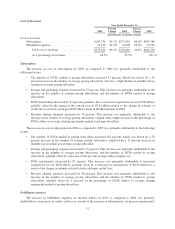

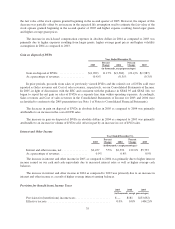

Cost of Revenues:

Subscription:

We acquire titles for our library through traditional direct purchase and through revenue sharing agreements

with content providers. Traditional buying methods normally result in higher upfront costs than titles obtained

through revenue sharing agreements. Cost of subscription revenues consists of revenue sharing expenses,

amortization of our DVD library, amortization of intangible assets related to equity instruments issued to certain

studios in 2000 and 2001 and postage and packaging costs related to shipping titles to paying subscribers. Costs

related to free-trial subscribers are allocated to marketing expenses.

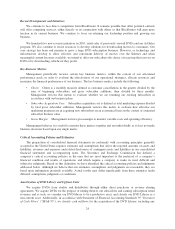

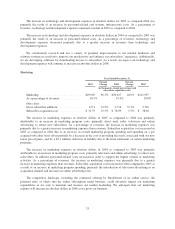

Revenue Sharing Expenses. Our revenue sharing agreements generally commit us to pay an initial upfront

fee for each DVD acquired and also a percentage of revenue earned from such DVD rentals for a defined period

of time. A portion of the initial upfront fees are non-recoupable for revenue sharing purposes and are capitalized

and amortized in accordance with our DVD library amortization policy. The remaining portion of the initial

upfront fee represents prepaid revenue sharing and this amount is expensed as revenue sharing expenses as

DVDs subject to revenue sharing agreements are shipped to subscribers. The terms of some revenue sharing

agreements with studios obligate us to make minimum revenue sharing payments for certain titles. We amortize

minimum revenue sharing prepayments (or accrete an amount payable to studios if the payment is due in arrears)

as revenue sharing obligations are incurred. A provision for estimated shortfall, if any, on minimum revenue

sharing payments is made in the period in which the shortfall becomes probable and can be reasonably estimated.

Additionally, the terms of some revenue sharing agreement with studios provide for rebates based on achieving

specified performance levels. We accrue for these rebates as earned based on historical title performance and

estimates of demand for the titles over the remainder of the title term.

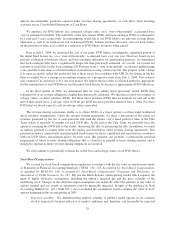

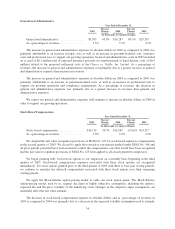

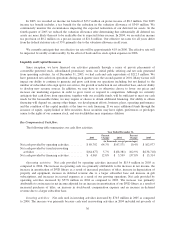

Amortization of DVD Library. On July 1, 2004, we revised the estimate of useful life for the back-

catalogue DVD library from one to three years. New releases will continue to be amortized over a one-year

period. We also revised our estimate of salvage values, on direct purchase DVDs. For those direct purchase

DVDs that we expect to sell at the end of their useful lives, a salvage value of $3.00 per DVD has been provided

effective July 1, 2004. For those DVDs that we do not expect to sell, no salvage value is provided.

Amortization of Studio Intangible Assets. In 2000 and 2001, in connection with signing revenue sharing

agreements with certain studios, we agreed to issue to each of these studios our Series F Non-Voting Preferred

Stock. The studios’ Series F Preferred Stock automatically converted into 3,192,830 shares of common stock

upon the closing of our initial public offering. We measured the original issuances and any subsequent

adjustments using the fair value of the securities at the issuance and any subsequent adjustment dates. The fair

value was recorded as an intangible asset and is amortized to cost of subscription revenues ratably over the

remaining term of the agreements which initial terms were either three or five years. As of December 31, 2005,

all studio intangible assets were fully amortized.

Postage and Packaging. Postage and packaging expenses consist of the postage costs to mail titles to and

from our paying subscribers and the packaging and label costs for the mailers. The rate for first-class postage was

$0.37 between June 29, 2002 and January 7, 2006. The U.S. Postal Service increased the rate of first class

27