NetFlix 2005 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2005 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share and per share data and percentages)

In estimating expected volatility, the Company considers historical volatility, volatility in market-traded

options on its common stock and other relevant factors in accordance with SFAS No. 123. In light of the

guidance in SAB 107, the Company reevaluated the assumptions used to estimate the value of stock options

granted in the second quarter of 2005. The Company revised the volatility factor used to estimate the fair value of

stock-based compensation awarded beginning in second quarter of 2005 to be based on a blend of historical

volatility of its common stock and implied volatility of tradable forward call options to purchase shares of its

common stock. Prior to the second quarter of 2005, the Company estimated future volatility based on historical

volatility of its common stock over the most recent period commensurate with the estimated expected life of the

Company’s stock options.

In addition, the Company bases its expected life assumption on several factors, including the historical

option exercise behavior of its employees and the terms and vesting periods of the options granted. Beginning

with the second quarter of 2004, the Company bifurcated its option grants into two employee groupings

(executive and non-executive) based on exercise behavior and changed the estimate of the expected life from 1.5

years for all option grants in the first quarter of 2004 to 2.5 years for one group and 1 year for the other group in

the second quarter of 2004. In the second quarter of 2005, in light of the guidance in SAB 107, the Company

refined its estimate of expected term for option grants from 2.5 years for one group and 1 year for the other group

to 4 years and 3 years, respectively. The Company will continue to monitor the assumptions used to measure

stock-based compensation.

The weighted-average fair value of employee stock options granted during 2003, 2004 and 2005 was $5.98,

$8.45 and $6.16 per share, respectively. The weighted-average fair value of shares granted under the employee

stock purchase plan during 2003, 2004 and 2005 was $4.43, $10.00 and $6.68 per share, respectively.

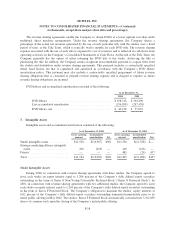

9. Income Taxes

The components of provision for (benefit from) income taxes for all periods presented were as follows:

Year Ended December 31,

2003 2004 2005

Current tax provision:

Federal ......................................... $— $ 4 $ 633

State ........................................... — 1 580

Total current ................................ — 5 1,213

Deferred tax provision:

Federal ......................................... — — (31,453)

State ........................................... — — (3,452)

Total deferred ............................... — — (34,905)

Amounts credited to equity for realized benefit of additional

tax stock option deductions ........................... — 176 —

Provision for (benefit from) income taxes ................. $— $181 $(33,692)

F-27