NetFlix 2005 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2005 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

related costs resulting from the higher volume of activities in our customer service and shipping centers and an

increase in facility-related costs resulting from expansion of certain of our shipping centers and the addition of

new ones.

The increase in fulfillment expenses in absolute dollars in 2004 as compared to 2003 was primarily

attributable to an increase in personnel-related costs resulting from the higher volume of activities in our

customer service and shipping centers, coupled with an increase in credit card fees as a result of the increase in

subscriptions. In addition, the increase in fulfillment expenses was attributable to an increase in facility-related

costs resulting from the relocation or expansion of certain of our shipping centers and the addition of new ones.

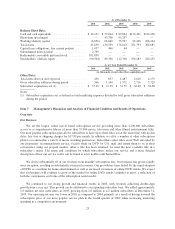

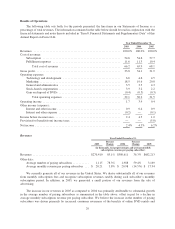

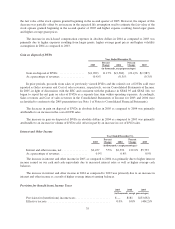

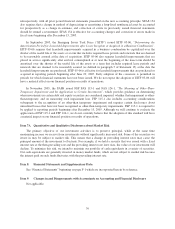

Gross Margin

Year Ended December 31,

2003

Percent

Change 2004

Percent

Change 2005

(in thousands, except percentages)

Gross profit .......................... $91,400 86.7% $170,601 27.6% $217,663

Gross margin ......................... 33.8% 34.1% 31.9%

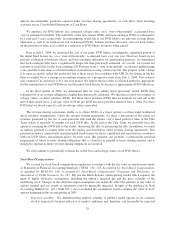

In 2005, in light of discussions with the Securities and Exchange Commission (“SEC”), we reclassified

fulfillment expenses in our Consolidated Statements of Income as a component of Cost of revenues. In prior

periods we had reported fulfillment expenses as a component of Operating expenses. Accordingly, Cost of

revenues, Gross profit and Operating expenses in the Consolidated Statements of Income for 2003 and 2004 have

been reclassified to conform to the 2005 presentation. (See Note 1 of Notes to Consolidated Financial

Statements).

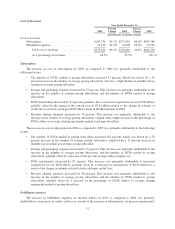

The decline in gross margin in 2005 as compared to 2004 was primarily attributable to the increase in cost

of subscription, offset in part by a decrease in fulfillment expenses as a percentage of revenue. Cost of

subscription increased due to a decline in revenue per paid shipment as a result of the price decrease of our most

popular service plan implemented in the fourth quarter of 2004, offset partially by the change in estimate related

to the useful life of our back-catalogue DVD library and the rapid growth of lower priced plans which produce a

higher margin than our most popular subscription plan of $17.99 per month. In addition, the gross margin for

2004 was favorably impacted by certain credits received from studios resulting from amendments to revenue

sharing agreements.

If movie rentals per average paying subscriber increases or if we see more shipments of DVDs subject to

revenue share, additional erosion in our gross margin will occur. Additionally, the increase in postage rates

effective January 8, 2006, may adversely impact our gross margin.

Gross margin increased slightly in 2004 as compared to 2003. This increase was primarily attributable to a

decline in fulfillment expenses as a percentage of revenues.

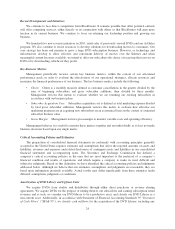

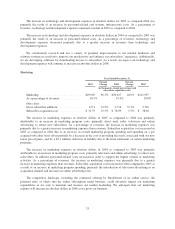

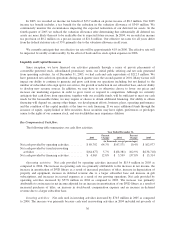

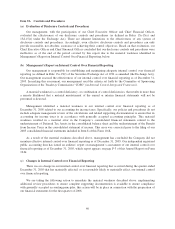

Operating Expenses:

Technology and Development

Year Ended December 31,

2003

Percent

Change 2004

Percent

Change 2005

(in thousands, except percentages)

Technology and development .............. $17,884 28.1% $22,906 35.1% $30,942

As a percentage of revenues ............... 6.6% 4.6% 4.5%

32