NetFlix 2005 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2005 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share and per share data and percentages)

The revenue sharing agreements enable the Company to obtain DVDs at a lower upfront cost than under

traditional direct purchase arrangements. Under the revenue sharing agreements, the Company shares a

percentage of the actual net revenues generated by the use of each particular title with the studios over a fixed

period of time, or the Title Term, which is typically twelve months for each DVD title. The revenue sharing

expense associated with the use of each title is expensed to cost of revenues and is reflected in cash flows from

operating activities on the Company’s Consolidated Statements of Cash Flows. At the end of the Title Term, the

Company generally has the option of either returning the DVD title to the studio, destroying the title or

purchasing the title. In addition, the Company remits an upfront non-refundable payment to acquire titles from

the studios and distributors under revenue sharing agreements. This payment includes a contractually specified

initial fixed license fee that is capitalized and amortized in accordance with the Company’s DVD library

amortization policy. This payment may also include a contractually specified prepayment of future revenue

sharing obligations that is classified as prepaid revenue sharing expense and is charged to expense as future

revenue sharing obligations are incurred.

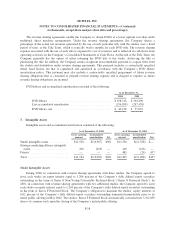

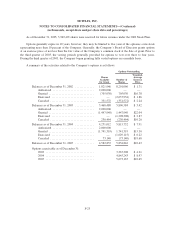

DVD library and accumulated amortization consisted of the following:

As of December 31,

2004 2005

DVD library .......................................... $198,216 $ 304,490

Less accumulated amortization ........................... (156,058) (247,458)

DVD library, net. ...................................... $ 42,158 $ 57,032

3. Intangible Assets

Intangible assets and accumulated amortization consisted of the following:

As of December 31, 2004 As of December 31, 2005

Gross carrying

amount

Accumulated

amortization Net

Gross carrying

amount

Accumulated

amortization Net

Studio intangible assets ............. $11,528 $(10,567) $961 $11,528 $(11,528) $—

Strategic marketing alliance intangible

assets ......................... 416 (416) — 416 (416) —

Patents .......................... — — — 481 (24) 457

Total ............................ $11,944 $(10,983) $961 $12,425 $(11,968) $457

Studio Intangible Assets

During 2000, in connection with revenue sharing agreements with three studios, the Company agreed to

issue each studio an equity interest equal to 1.204 percent of the Company’s fully diluted equity securities

outstanding in the form of Series F Non-Voting Convertible Preferred Stock (“Series F Preferred Stock”). In

2001, in connection with revenue sharing agreements with two additional studios, the Company agreed to issue

each studio an equity interest equal to 1.204 percent of the Company’s fully diluted equity securities outstanding

in the form of Series F Preferred Stock. The Company’s obligation to maintain the studios’ equity interests at

6.02 percent of the Company’s fully diluted equity securities outstanding terminated immediately prior to its

initial public offering in May 2002. The studios’ Series F Preferred Stock automatically converted into 3,192,830

shares of common stock upon the closing of the Company’s initial public offering.

F-18