NetFlix 2005 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2005 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

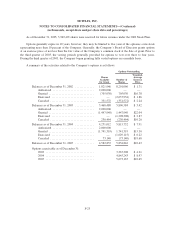

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share and per share data and percentages)

On October 19, 2004, Doris Staehr and Steve Staehr, shareholders claiming to be acting on the Company’s

behalf, filed a shareholder derivative suit in the Superior Court of the State of California for the County of Santa

Clara against certain officers and certain current and former members of the board of directors, specifically Reed

Hastings, Barry McCarthy, Thomas R. Dillon, Leslie J. Kilgore, Richard Barton, Timothy Haley, Jay Hoag, A.

Robert Pisano, Michael Schuh and Michael Ramsay. The plaintiffs claim that the named defendants breached

their fiduciary duties by allowing allegedly false and misleading statements to be made regarding, among other

things, churn. They also claim that the named defendants illegally traded the Company’s stock while in

possession of material nonpublic information. In addition, the plaintiffs assert claims for abuse of control, gross

mismanagement, waste and unjust enrichment. The lawsuit seeks, on the Company’s behalf, unspecified

compensatory and enhanced damages, disgorgement of profits earned through alleged insider trading, recovery of

attorneys’ fees and costs, and other relief. Following a request for dismissal by the plaintiffs, the Court dismissed

the action without prejudice on January 18, 2006.

7. Guarantees—Intellectual Property Indemnification Obligations

In the ordinary course of business, the Company has entered into contractual arrangements under which it

has agreed to provide indemnification of varying scope and terms to business partners and other parties with

respect to certain matters, including, but not limited to, losses arising out of the Company’s breach of such

agreements and out of intellectual property infringement claims made by third parties. In these circumstances,

payment by the Company is conditional on the other party making a claim pursuant to the procedures specified in

the particular contract, which procedures typically allow the Company to challenge the other party’s claims.

Further, the Company’s obligations under these agreements may be limited in terms of time and/or amount, and

in some instances, the Company may have recourse against third parties for certain payments made by it under

these agreements. In addition, the Company has entered into indemnification agreements with its directors and

certain of its officers that will require it, among other things, to indemnify them against certain liabilities that

may arise by reason of their status or service as directors or officers. The terms of such obligations vary.

It is not possible to make a reasonable estimate of the maximum potential amount of future payments under

these or similar agreements due to the conditional nature of the Company’s obligations and the unique facts and

circumstances involved in each particular agreement. No amount has been accrued in the accompanying financial

statements with respect to these indemnification guarantees.

8. Stockholders’ Equity

Preferred Stock

The Company has authorized 10 million shares of undesignated preferred stock with par value of $0.001 per

share. None of the preferred shares were issued and outstanding at December 31, 2004 and 2005.

Stock Split

On January 16, 2004, the Company’s Board of Directors approved a two-for-one split in the form of a stock

dividend on all outstanding shares of its common stock. As a result of the stock split, the Company’s

stockholders received one additional share for each share of common stock held on the record date of February 2,

2004. The additional shares of common stock were distributed on February 11, 2004. All common share and

per-share amounts in the consolidated financial statements and related notes have been retroactively adjusted to

reflect the stock split for all periods presented. In addition, the Company has reclassified $26 from additional

paid-in capital to common stock as of December 31, 2003.

F-23