NetFlix 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share and per share data and percentages)

Income Taxes

The Company accounts for income taxes using the asset and liability method. Deferred income taxes are

recognized by applying enacted statutory tax rates applicable to future years to differences between the financial

statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and

tax credit carryforwards. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in

income in the period that includes the enactment date. The measurement of deferred tax assets is reduced, if

necessary, by a valuation allowance for any tax benefits for which future realization is uncertain.

Comprehensive Income (Loss)

The Company reports comprehensive income or loss in accordance with the provisions of SFAS No. 130,

“Reporting Comprehensive Income”, which establishes standards for reporting comprehensive income and its

components in the financial statements. The components of other comprehensive income (loss) consist of

unrealized gains and losses on available-for-sale securities and cumulative translation adjustments. Total

comprehensive loss and the components of accumulated other comprehensive income are presented in the

accompanying consolidated statements of stockholders’ equity (deficit). Tax effects of other comprehensive

income (loss) are not material for any period presented.

Net Income Per Share

Basic net income per share is computed using the weighted-average number of outstanding shares of

common stock during the period. Diluted net income per share is computed using the weighted-average number

of outstanding shares of common stock and, when dilutive, potential common shares outstanding during the

period. Potential common shares consist primarily of incremental shares issuable upon the assumed exercise of

stock options, warrants to purchase common stock and shares currently purchasable pursuant to our employee

stock purchase plan using the treasury stock method.

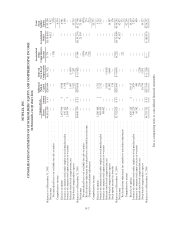

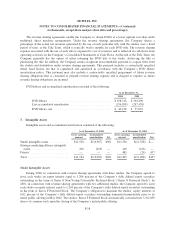

The shares used in the computation of net income per share are as follows (rounded to the nearest thousand):

Year Ended December 31,

2003 2004 2005

Weighted-average shares outstanding—basic ...... 47,786,000 51,988,000 53,528,000

Effect of dilutive potential common shares:

Warrants. .............................. 9,972,000 8,571,000 8,354,000

Employee stock options .................. 5,126,000 4,154,000 3,636,000

Weighted-average shares outstanding—diluted. .... 62,884,000 64,713,000 65,518,000

Employee stock options with exercises prices greater than the average market price of the common stock were

excluded from the diluted calculation as their inclusion would have been anti-dilutive. The following table

summarizes the potential common shares excluded from the diluted calculation (rounded to the nearest thousand):

Year Ended December 31,

2003 2004 2005

Employee stock options ......................... 113,000 676,000 1,023,000

The weighted average exercise price of excluded outstanding stock options was $17.03, $30.71 and $28.39

for the years ended December 31, 2003, 2004 and 2005, respectively.

F-14