NetFlix 2005 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2005 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share and per share data and percentages)

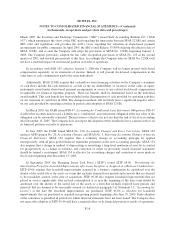

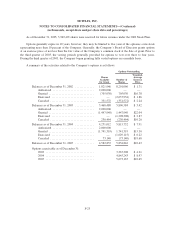

The following table summarizes information on outstanding and exercisable options as of December 31,

2005:

Options Outstanding

Options Exercisable

Exercise Price

Number of

Options

Weighted-

Average

Remaining

Contractual

Life (Years)

Weighted-

Average

Exercise

Price

Number of

Options

Weighted-

Average

Exercise

Price

$0.08–$1.50 2,680,827 5.76 $ 1.50 2,590,865 $ 1.50

$1.51–$10.83 717,346 8.00 $ 7.90 639,811 $ 8.20

$10.84–$14.27 741,913 8.77 $12.03 727,761 $12.05

$14.28–$21.45 748,434 9.05 $17.70 748,434 $17.70

$21.46–$34.75 741,232 8.70 $28.48 741,232 $28.48

$34.76–$36.38 225,064 8.25 $35.87 225,064 $35.87

5,854,816 7.31 $10.43 5,673,167 $10.65

Stock-Based Compensation

Prior to the second quarter of 2003, the Company accounted for its stock-based employee compensation

plans using the intrinsic-value method. During the second quarter of 2003, the Company adopted the fair value

recognition provisions of SFAS No. 123, Accounting for Stock-Based Compensation, as amended by SFAS

No. 148, Accounting for Stock-Based Compensation—Transition and Disclosure, an Amendment of FASB

Statement No. 123, for all stock-based compensation. The Company elected to apply the retroactive restatement

method under SFAS No. 148 and all prior periods presented have been restated to reflect the compensation costs

that would have been recognized had the fair value recognition provisions of SFAS No. 123 been applied to all

awards granted.

During the third quarter of 2003, the Company began granting stock options to its employees on a monthly

basis. Such stock options are designated as non-qualified stock options and vest immediately, in comparison with

the three to four-year vesting periods for stock options granted prior to the third quarter of 2003. As a result of

immediate vesting, stock-based compensation expense determined under SFAS No. 123 is fully recognized upon

the stock option grants. For those stock options granted prior to the third quarter of 2003 with three to four-year

vesting periods, the Company continues to amortize the deferred compensation related to the stock options over

their remaining vesting periods using the accelerated multiple-option approach.

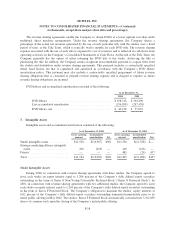

The fair value of employee stock options granted as well as the fair value of shares issued under the

employee stock purchase plan was estimated using the Black-Scholes option pricing model. The following table

summarizes the weighted-average assumptions used to value option grants:

Stock Options Employee Stock Option Plan

2003 2004 2005 2003 2004 2005

Dividend yield ............. 0% 0% 0% 0% 0% 0%

Expected volatility ......... 69% 78% 59% 68% 77% 45%

Risk-free interest rate ....... 1.59% 2.23% 3.67% 1.34% 1.83% 3.80%

Expected life (in years) ...... 1.95 1.85 3.08 1.3 1.3 1.3

F-26