NetFlix 2005 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2005 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

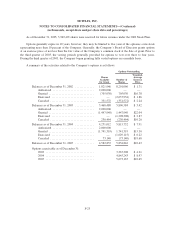

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share and per share data and percentages)

Property and equipment included approximately $6,173 of assets under capital leases as of December 31,

2004 and 2005. Accumulated amortization under these leases totaled $6,156 and $6,173 as of December 31, 2004

and 2005, respectively. The related amortization is included in depreciation expense.

Internal-use software included approximately $6,301 and $8,054 of internally incurred capitalized software

development costs as of December 31, 2004 and 2005, respectively. Accumulated amortization of capitalized

software development costs totaled $5,408 and $6,959 as of December 31, 2004 and 2005, respectively.

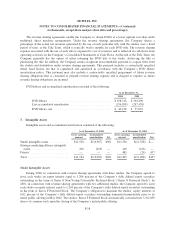

Accrued Expenses

Accrued expenses consisted of the following:

As of December 31, 2005

2004 2005

Accrued state sales and use tax ............................. $ 4,736 $ 6,656

Employee benefits ....................................... 2,709 3,513

Accrued settlement costs .................................. — 8,589

Other ................................................. 5,686 6,805

Total accrued expenses ................................... $ 13,131 $ 25,563

5. Warrants

In April 2000, in connection with the sale of Series E preferred stock, the Company sold warrants to

purchase 533,003 shares of Series E preferred stock at a price of $0.01 per share. The warrants had an exercise

price of $14.07 per share. In July 2001, in connection with a modification of the terms of the Series E preferred

stock, certain Series E warrant holders agreed to the cancellation of warrants to purchase 500,487 shares of Series

E preferred stock. The remaining warrants to purchase 32,516 shares of Series E preferred stock were exercisable

at $14.07 per share. These shares automatically converted into 44,298 shares of the Company’s common stock at

$10.33 per share upon the closing of the initial public offering in May 2002. As of December 31, 2004, warrants

to purchase 44,298 shares of the Company’s common stock were outstanding. The warrants were exercised in

2005, and accordingly, none of these warrants were outstanding as of December 31, 2005.

In November 2000, in connection with an operating lease, the Company issued a warrant that provided the

lessor the right to purchase 40,000 shares of common stock at $3.00 per share. The Company accounted for the

fair value of the warrant of approximately $216 as an increase to additional paid-in capital with a corresponding

increase to other assets. This asset is being amortized over the term of the related operating lease, which is five

years. The warrants were exercised in 2004 and accordingly, as of December 31, 2004 and December 31, 2005,

no warrants were outstanding in connection with the operating lease.

In July 2001, in connection with borrowings under subordinated promissory notes, the Company issued to

the note holders warrants to purchase 13,637,894 shares of the Company’s common stock at $1.50 per share. The

Company accounted for the fair value of the warrants of $10,884 as an increase to additional paid-in capital with

a corresponding discount on subordinated notes payable. As of December 31, 2003, warrants to purchase

9,112,870 shares of the Company’s common stock remained outstanding. Warrants to purchase 12,750 shares

were exercised in 2004 and accordingly, as of December 31, 2004, warrants to purchase 9,100,120 shares of the

Company’s common stock remained outstanding. In 2005, warrants to purchase 1,894 shares were exercised, and

accordingly, 9,098,226 warrants were outstanding as of December 31, 2005.

F-20