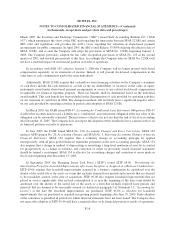

NetFlix 2005 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2005 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

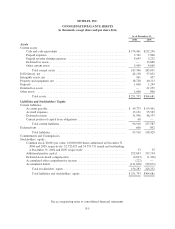

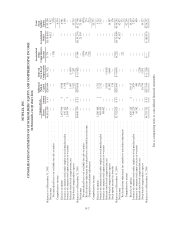

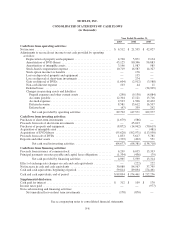

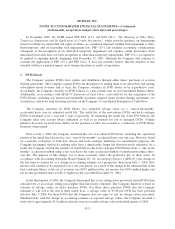

NETFLIX, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY AND COMPREHENSIVE INCOME

(in thousands, except share data)

Common Stock Additional

Paid-in

Capital

Deferred

Stock-Based

Compensation

Accumulated

Other

Comprehensive

Income

Accumulated

Deficit

Total

Stock-

holders’

EquityShares Amount

Balances as of December 31, 2002 ................................... 44,891,590 $ 45 $260,044 $(11,702) $ 774 $(159,805) $ 89,356

Net income .................................................... — — — — — 6,512 6,512

Net unrealized losses on available-for-sale securities ................. — — — — (178) — (178)

Comprehensive income .......................................... 6,334

Exercise of options ............................................. 2,657,934 3 4,938 — — — 4,941

Issuance of common stock under employee stock purchase plan .......... 345,112 — 1,358 — — — 1,358

Issuance of common stock upon exercise of warrants .................. 2,954,734 3 (3) — — — —

Deferred stock-based compensation, net ............................. — — 1,067 (1,067) — — —

Stock-based compensation expense ................................ — — 3,432 7,287 — — 10,719

Balances as of December 31, 2003 ................................... 50,849,370 $ 51 $270,836 $ (5,482) $ 596 $(153,293) $112,708

Net income .................................................... — — — — — 21,595 21,595

Net unrealized losses on available-for-sale securities ................. — — — — (870) — (870)

Reclassification adjustment for realized losses included in net income . . . — — — — 274 — 274

Cumulative translation adjustment ............................... — — — — (222) — (222)

Comprehensive income .......................................... 20,777

Exercise of options ............................................. 1,298,308 1 3,721 — — — 3,722

Issuance of common stock under employee stock purchase plan .......... 495,455 1 2,312 — — — 2,313

Issuance of common stock upon exercise of warrants .................. 88,892 — — — — — —

Deferred stock-based compensation, net ............................. — — 3,815 (3,815) — — —

Stock-based compensation expense ................................ — — 11,983 4,604 — — 16,587

Stock option income tax benefits .................................. — — 176 — — — 176

Balances as of December 31, 2004 ................................... 52,732,025 $ 53 $292,843 $ (4,693) $(222) $(131,698) $156,283

Net income .................................................... — — — — — 42,027 42,027

Reclassification adjustment for cumulative translation adjustment ...... — — — — 222 — 222

Comprehensive income ........................................ 42,249

Exercise of options ........................................... 1,629,115 2 10,117 — — — 10,119

Issuance of common stock under employee stock purchase plan .......... 349,229 — 2,824 — — — 2,824

Issuance of common stock upon exercise of warrants .................. 45,362 — 450 — — — 450

Deferred stock-based compensation, net ............................. — — 226 (226) — — —

Stock-based compensation expense ................................ — — 10,734 3,593 — — 14,327

Balances as of December 31, 2005 ................................... 54,755,731 $ 55 $317,194 $ (1,326) $ — $ (89,671) $226,252

See accompanying notes to consolidated financial statements.

F-7