NetFlix 2005 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2005 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

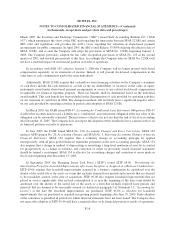

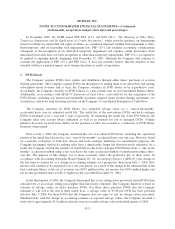

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share and per share data and percentages)

In November 2005, the FASB issued FSP FAS 115-1 and FAS 124-1, “The Meaning of Other-Than-

Temporary Impairment and Its Application to Certain Investments”, which provides guidance on determining

when investments in certain debt and equity securities are considered impaired, whether that impairment is other-

than-temporary, and on measuring such impairment loss. FSP 115-1 also includes accounting considerations

subsequent to the recognition of an other-than temporary impairment and requires certain disclosures about

unrealized losses that have not been recognized as other-than-temporary impairments. FSP 115-1 is required to

be applied to reporting periods beginning after December 15, 2005. Although the Company will continue to

evaluate the application of FSP 115-1 and FSP 124-1, it does not currently believe that the adoption of this

standard will have a material impact on its financial position or results of operations.

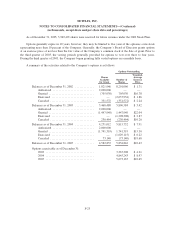

2. DVD Library

The Company acquires DVDs from studios and distributors through either direct purchases or revenue

sharing agreements. The Company acquires DVDs for the purpose of renting them to its subscribers and earning

subscription rental revenues and as such, the Company considers its DVD library to be a productive asset.

Accordingly, the Company classifies its DVD Library as a non-current asset on its Consolidated Balance Sheet.

Additionally, in accordance with SFAS 95 Statement of Cash Flows, cash outflows for the acquisition of the

DVD Library, including any upfront non-refundable payments required under revenue sharing agreements, are

classified as cash flows from investing activities on the Company’s Consolidated Statements of Cash Flows.

The Company amortizes its DVD library, less estimated salvage value, on a “sum-of-the-months”

accelerated basis over its estimated useful life. The useful life of the new-release DVDs and back-catalogue

DVDs is estimated to be 1 year and 3 years, respectively. In estimating the useful life of the DVD library, the

Company takes into account library utilization as well as an estimate for lost or damaged DVDs. Volume

purchase discounts received from studios on the purchase of titles are recorded as a reduction of DVD library

inventory when earned.

Prior to July 1, 2004, the Company amortized the cost of its entire DVD library, including the capitalized

portion of the initial fixed license fee, on a “sum-of-the-months” accelerated basis over one year. However, based

on a periodic evaluation of both new release and back-catalogue utilization for amortization purposes, the

Company determined that back-catalogue titles have a significantly longer life than previously estimated. As a

result, the Company revised the estimate of useful life for the back-catalogue DVD library from a “sum of the

months” accelerated method using a one year life to the same accelerated method of amortization using a three-

year life. The purpose of this change was to more accurately reflect the productive life of these assets. In

accordance with Accounting Principles Board Opinion No. 20, Accounting Changes (“APB 20”), the change in

life has been accounted for as a change in accounting estimate on a prospective basis from July 1, 2004. New

releases will continue to be amortized over a one year period. As a result of the change in the estimated life of the

back-catalogue library, total cost of revenues was $10.9 million lower, net income was $10.9 million higher and

net income per diluted share was $0.17 higher for the year ended December 31, 2004.

In the third quarter of 2004, the Company determined that it was selling fewer previously rented DVDs than

estimated but at an average selling price higher than historically estimated. The Company therefore revised its

estimate of salvage values on direct purchase DVDs. For those direct purchase DVDs that the Company

estimates it will sell at the end of their useful lives, a salvage value of $3.00 per DVD has been provided

effective July 1, 2004. For those DVDs that the Company does not expect to sell, no salvage value is provided.

Simultaneously with the change in accounting estimate of expected salvage values, the Company recorded a

write-off of approximately $1.9 million related to non-recoverable salvage value in the third quarter of 2004.

F-17