NetFlix 2005 Annual Report Download - page 69

Download and view the complete annual report

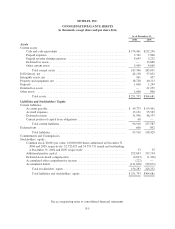

Please find page 69 of the 2005 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

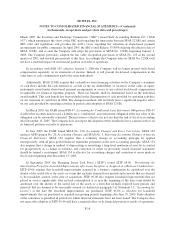

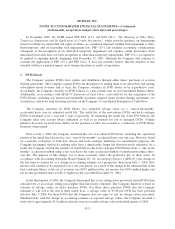

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data and percentages)

1. Organization and Summary of Significant Accounting Policies

Description of Business

Netflix, Inc. (the “Company”) was incorporated on August 29, 1997 (inception) and began operations on

April 14, 1998. The Company is an online movie rental subscription service, providing subscribers with access to

a comprehensive library of titles. The Company’s most popular subscription plan allows subscribers to have up

to three titles out at the same time with no due dates, late fees or shipping charges for $17.99 per month. In

addition, the Company offers a number of other subscription plans to accommodate a variety of movie watching

preferences. Subscribers select titles at the Company’s Web site aided by its proprietary recommendation service,

receive them on DVD by U.S. mail and return them to the Company at their convenience using the Company’s

prepaid mailers. After a title has been returned, the Company mails the next available title in a subscriber’s

queue. All of the Company’s revenues are generated in the United States.

Basis of Presentation

The consolidated financial statements include the accounts of the Company and its wholly-owned United

Kingdom subsidiary. Intercompany balances and transactions have been eliminated. In the fourth quarter of 2005,

the Company filed an application to dissolve its United Kingdom subsidiary.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the

United States of America requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial

statements, and the reported amounts of revenues and expenses during the reporting periods. Significant items

subject to such estimates and assumptions include the estimate of useful lives and residual value of its DVD

library; the valuation of stock-based compensation; and the recognition and measurement of income tax assets

and liabilities. On an ongoing basis, the Company evaluates its estimates, including those related to the useful

lives and residual values surrounding the Company’s DVD library. The Company bases its estimates on

historical experience and on various other assumptions that the Company believes to be reasonable under the

circumstances. Actual results may differ from these estimates.

Reclassifications

Certain amounts in the Company’s prior years’ Consolidated Statements of Income were reclassified to

conform with the current period presentation. Proceeds from sales of previously viewed DVDs and the related

cost of DVDs sold were reported as Sales revenues and Cost of sales revenues, respectively, on our Consolidated

Statements of Income in previous years. In 2005, in light of discussions with the SEC and consistent with the

guidance in Statement of Financial Accounting Standards (“SFAS”) 95, “Statement of Cash Flows,” and SFAS

144, “Accounting for the Impairment or Disposal of Long-Lived Assets”, the Company began to report the net

gain on sales of DVDs as a separate line item within Operating income. Accordingly, Sales revenues and Cost of

sales revenues contained in the Consolidated Statements of Income for 2003 and 2004 have been reclassified to

conform to the 2005 presentation. Cash flows associated with the acquisition of its DVD Library and proceeds

from sale of DVDs continue to be classified as cash flows from investing activities in the Consolidated

Statements of Cash Flows.

Additionally, in 2005 in light of discussions with the SEC, the Company reclassified fulfillment expenses in

its Consolidated Statements of Income as a component of Cost of revenues. In prior periods the Company had

reported Fulfillment expenses as a component of Operating expenses. Accordingly, Cost of revenues, Gross

F-9