NetFlix 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.retrospectively with all prior period financial statements presented on the new accounting principle. SFAS 154

also requires that a change in method of depreciating or amortizing a long-lived nonfinancial asset be accounted

for prospectively as a change in estimate, and correction of errors in previously issued financial statements

should be termed a restatement. SFAS 154 is effective for accounting changes and correction of errors made in

fiscal years beginning after December 15, 2005.

In September 2005, the Emerging Issues Task Force (“EITF”) issued EITF 05-06, “Determining the

Amortization Period for Leasehold Improvements after Lease Inception or Acquired in a Business Combination”.

EITF 05-06 requires that leasehold improvements acquired in a business combination be capitalized over the

shorter of the useful life of the assets or a term that includes required lease periods and renewals that are deemed

to be reasonably assured at the date of acquisition. EITF 05-06 also requires leasehold improvements that are

placed in service significantly after and not contemplated at or near the beginning of the lease term should be

amortized over the shorter of the useful life of the assets or a term that includes required lease periods and

renewals that are deemed to be reasonably assured (as defined in paragraph 5 of Statement 13) at the date the

leasehold improvements are purchased. EITF 05-06 is effective for leasehold improvements that are purchased or

acquired in reporting periods beginning after June 29, 2005. Early adoption of the consensus is permitted in

periods for which financial statements have not been issued. We do not expect the adoption of EITF 05-06 will

have a material effect on our financial position or results of operations.

In November 2005, the FASB issued FSP FAS 115-1 and FAS 124-1, “The Meaning of Other-Than-

Temporary Impairment and Its Application to Certain Investments”, which provides guidance on determining

when investments in certain debt and equity securities are considered impaired, whether that impairment is other-

than-temporary, and on measuring such impairment loss. FSP 115-1 also includes accounting considerations

subsequent to the recognition of an other-than temporary impairment and requires certain disclosures about

unrealized losses that have not been recognized as other-than-temporary impairments. FSP 115-1 is required to

be applied to reporting periods beginning after December 15, 2005. Although we will continue to evaluate the

application of FSP 115-1 and FSP 124-1, we do not currently believe that the adoption of this standard will have

a material impact on our financial position or results of operations.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

The primary objective of our investment activities is to preserve principal, while at the same time

maximizing income we receive from investments without significantly increased risk. Some of the securities we

invest in may be subject to market risk. This means that a change in prevailing interest rates may cause the

principal amount of the investment to fluctuate. For example, if we hold a security that was issued with a fixed

interest rate at the then-prevailing rate and the prevailing interest rate later rises, the value of our investment will

decline. To minimize this risk, we intend to maintain our portfolio of cash equivalents in a variety of securities.

Our cash equivalents are generally invested in money market funds, which are not subject to market risk because

the interest paid on such funds fluctuates with the prevailing interest rate.

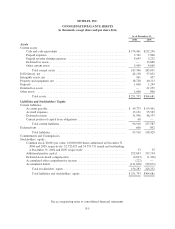

Item 8. Financial Statements and Supplementary Data

See “Financial Statements” beginning on page F-1 which are incorporated herein by reference.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

Not applicable.

39