NetFlix 2005 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2005 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

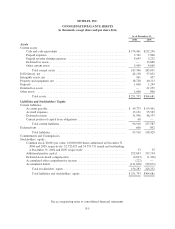

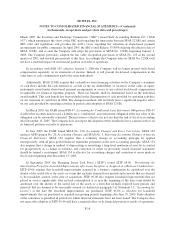

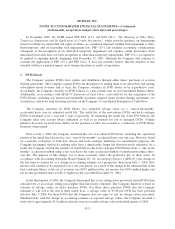

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share and per share data and percentages)

The Company capitalizes film costs in accordance with Statement of Position 00-2 (“SOP 00-2”)

Accounting by Producers or Distributors of Films. Net capitalized film costs are recorded within DVD Library as

such amounts are currently not material to the consolidated financial statements. Capitalized film costs include

costs to develop and produce movies, which primarily consist of concept development, pre-production and

production. Capitalized film costs are stated at the lower of unamortized cost or estimated fair value on an

individual film basis. Once a film is released, capitalized film production costs shall be amortized in the

proportion that the revenue during the period for each film bears to the estimated total revenue to be received

from all sources for the film (“Ultimate Revenue”) under the individual-film-forecast method as defined in SOP

00-2. In the event a film is not set for production within three years from the time of the first capitalized

transaction, all such costs will be expensed. The Company makes certain estimates and judgments of Ultimate

Revenue for each film based on performance of comparable titles and our knowledge of the industry. Estimates

of Ultimate Revenue are reviewed periodically and are revised if necessary. Unamortized film production costs

are evaluated for impairment each quarter on a film-by-film basis in accordance with the requirements of SOP

00-2. If forecasts of Ultimate Revenue are not sufficient to recover the unamortized film costs for that film, the

unamortized film costs will be written down to fair value.

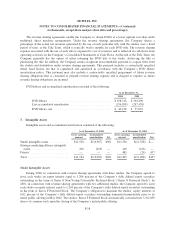

Amortization of Intangible Assets

Intangible assets are carried at cost less accumulated amortization. The Company amortizes the intangible

assets with finite lives using the straight-line method over the estimated economic lives of the assets, ranging

from approximately 2 to 10 years. See Note 3 for further discussion.

Property and Equipment

Property and equipment are carried at cost less accumulated depreciation. Depreciation is calculated using

the straight-line method over the shorter of the estimated useful lives of the respective assets, generally up to five

years, or the lease term, if applicable.

Impairment of Long-Lived Assets

In accordance with Statement of Financial Accounting Standards (“SFAS”) No. 144, “Accounting for the

Impairment or Disposal of Long-Lived Assets”, long-lived assets such as property and equipment and intangible

assets subject to amortization, are reviewed for impairment whenever events or changes in circumstances

indicate that the carrying amount of an asset group may not be recoverable. Recoverability of asset groups to be

held and used is measured by a comparison of the carrying amount of an asset group to estimated undiscounted

future cash flows expected to be generated by the asset group. If the carrying amount of an asset group exceeds

its estimated future cash flows, an impairment charge is recognized by the amount by which the carrying amount

of an asset group exceeds fair value of the asset group. The Company evaluated its long-lived assets and no

impairment charges were recorded for any of the years presented.

Capitalized Software Costs

The Company capitalizes costs related to developing or obtaining internal-use software. Capitalization of

costs begins after the conceptual formulation stage has been completed. Capitalized software costs are included

in property and equipment, net and are amortized over the estimated useful life of the software, which is

generally one year.

F-12