NetFlix 2005 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2005 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share and per share data and percentages)

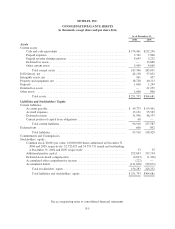

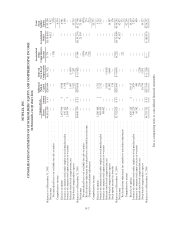

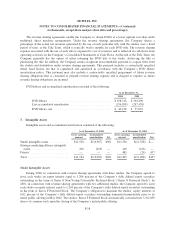

profit and Operating expenses in the Consolidated Statements of Income for 2003 and 2004 have been

reclassified to conform to the 2005 presentation.

The reclassifications did not impact operating income or net income, working capital or net cash provided

by operating activities as previously reported. The following amounts were reclassified for 2003 and 2004:

Year ended December 31, 2003 Year ended December 31, 2004

Consolidated Statements of Income

As previously

reported Reclassifications

As

Reclassified

As previously

reported Reclassifications

As

Reclassified

Revenues:

Subscription ................ $270,410 $ — $270,410 $500,611 $ — $500,611

Sales ...................... 1,833 (1,833) — 5,617 (5,617) —

Total revenues .......... 272,243 (1,833) 270,410 506,228 (5,617) 500,611

Cost of revenues: —

Subscription ................ 147,736 — 147,736 273,401 — 273,401

Sales ...................... 624 (624) — 3,057 (3,057) —

Fulfillment expenses ......... — 31,274 31,274 — 56,609 56,609

Total cost of revenues .... 148,360 30,650 179,010 276,458 53,552 330,010

Gross profit ..................... 123,883 (32,483) 91,400 229,770 (59,169) 170,601

Operating expenses:

Fulfillment ................. 31,274 (31,274) — 56,609 (56,609) —

Technology and development . . 17,884 — 17,884 22,906 — 22,906

Marketing .................. 49,949 — 49,949 98,027 — 98,027

General and administrative .... 9,585 — 9,585 16,287 — 16,287

Stock-based compensation ..... 10,719 — 10,719 16,587 — 16,587

Gain on disposal of DVDs ..... — (1,209) (1,209) — (2,560) (2,560)

Total operating expenses . . 119,411 (32,483) 86,928 210,416 (59,169) 151,247

Operating income ................ 4,472 — 4,472 19,354 — 19,354

Other income (expense):

Interest and other income ...... 2,457 — 2,457 2,592 — 2,592

Interest and other expense. ..... (417) — (417) (170) — (170)

Income before income taxes ....... 6,512 — 6,512 21,776 — 21,776

Provision for (benefit from) income

taxes ........................ — — — 181 — 181

Net income ..................... $ 6,512 $ — $ 6,512 $ 21,595 $ — $ 21,595

Stock Split

On January 16, 2004, the Company’s Board of Directors approved a two-for-one stock split in the form of a

stock dividend on all outstanding shares of the Company’s common stock. As a result of the stock split, the

Company’s stockholders received one additional share for each share of common stock held on the record date of

February 2, 2004. The additional shares of common stock were distributed on February 11, 2004. All common

share and per-share amounts in the accompanying consolidated financial statements and related notes have been

retroactively adjusted to reflect the stock split for all years presented.

Fair Value of Financial Instruments

The fair value of the Company’s cash, short-term investments, accounts payable, accrued expenses and

capital lease obligations approximates their carrying value due to their short maturity.

F-10