NetFlix 2005 Annual Report Download - page 71

Download and view the complete annual report

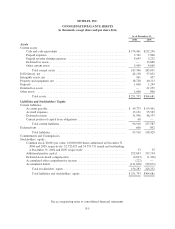

Please find page 71 of the 2005 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NETFLIX, INC.

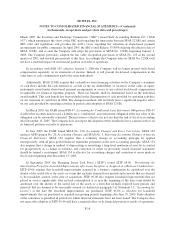

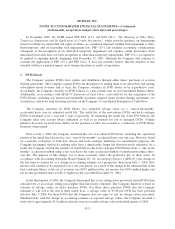

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share and per share data and percentages)

Foreign Currency Translation and Transactions

The financial statements of the Company’s United Kingdom subsidiary were prepared in its local currency

and translated into U.S. dollars for reporting purposes. The assets and liabilities are translated at exchange rates

in effect at the balance sheet date, while results of operations are translated at average exchange rates for the

respective periods. The cumulative effects of exchange rate changes on net assets are included as a part of

accumulated other comprehensive income. Net foreign currency transaction gains and losses were not significant

for any of the years presented.

In the fourth quarter of 2005, the Company substantially liquidated the assets and liabilities of its United

Kingdom subsidiary and accordingly, the cumulative translation adjustment was reclassified from accumulated

other comprehensive income in stockholders’ equity and reported in “Interest and Other Expense” for the period.

Cash and Cash Equivalents

The Company considers highly liquid instruments with original maturities of three months or less, at the

date of purchase, to be cash equivalents. The Company’s cash and cash equivalents are principally on deposit in

short-term asset management accounts at two large financial institutions.

Restricted Cash

As of December 31, 2005, other assets included restricted cash of $500 related to a workers’ compensation

insurance deposit.

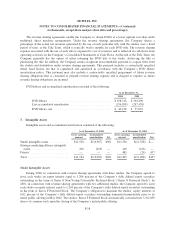

Short-Term Investments

The Company’s short-term investments are classified as available-for-sale and are recorded at fair market

value. Net unrealized gains (losses) are reflected in accumulated other comprehensive income. When the fair

value of an investment declines below its original cost, the Company considers all available evidence to evaluate

whether the decline in value is other-than-temporary. Among other things, the Company considers the duration

and extent to which the market value has declined relative to its cost basis and economic factors influencing the

markets, its ability and intent to hold the investments until a market price recovery, and the severity and duration

of the impairment. No impairment charges were recorded for the periods presented. Gains and losses on

securities sold are determined based on the average cost method and are included in “Interest and other income”

in the Consolidated Statements of Income.

During the second quarter of 2004, the Company completed the sale of its short-term investments and

recorded a realized loss of $274 from the transaction. All proceeds from the sale were re-invested in the

Company’s money market fund, which is classified as cash equivalents.

Amortization of DVD Library

The Company amortizes its DVD library, less estimated salvage value, on a “sum-of-the-months”

accelerated basis over its estimated useful life. The useful life of the new-release DVDs and back-catalogue

DVDs is estimated to be 1 year and 3 years, respectively. In estimating the useful life of its DVD library, the

Company takes into account library utilization as well as an estimate for lost or damaged DVDs. See Note 2 for

further discussion.

F-11