NetFlix 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NETFLIX, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(in thousands, except share and per share data and percentages)

In July 2001, in connection with a capital lease agreement, the Company granted warrants to purchase

170,000 shares of common stock at an exercise price of $1.50 per share. The fair value of approximately $172

was recorded as an increase to additional paid-in capital with a corresponding reduction to the capital lease

obligations. The debt discount is being accreted to interest expense over the term of the lease agreement, which is

45 months. As of December 31, 2004 and December 31, 2005, no warrants were outstanding in connection with

the capital lease agreement.

In July 2001, the Company issued a warrant to purchase 100,000 shares of Series F preferred stock at $9.38

per share to a Web portal company in connection with an integration and distribution agreement. The fair market

value of the warrants of approximately $18 was recorded as marketing expense and an increase to additional

paid-in capital. These shares automatically converted into 66,666 shares of the Company’s common stock at

$14.07 per share upon the closing of the initial public offering in May 2002. The warrant was exercised in 2004

and accordingly, as of December 31, 2004 and December 31, 2005, no warrants were outstanding in connection

with the integration and distribution agreement.

The Company calculated the fair value of the warrants using the Black-Scholes valuation model with the

following assumptions: the terms of the warrants ranging from 4 to 10 years; risk-free rates between 4.92% to

6.37%; volatility of 80%; and dividend yield of 0.0%.

6. Commitments and Contingencies

Lease Commitments

The Company leases facilities under non-cancelable operating leases with various expiration dates through

2012. The facilities generally require the Company to pay property taxes, insurance and maintenance costs.

Further, several lease agreements contain rent escalation clauses and/or rent holidays. For purposes of

recognizing minimum rental expenses on a straight-line basis over the terms of the leases, the Company uses the

date of initial possession to begin amortization, which is generally when the Company enters the space and

begins to make improvements in preparation of intended use. For scheduled rent escalation clauses during the

lease terms or for rental payments commencing at a date other than the date of initial occupancy, the Company

records minimum rental expenses on a straight-line basis over the terms of the leases on the consolidated

statements of earnings. The Company has the option to extend or renew most of its leases which may increase the

future minimum lease commitments.

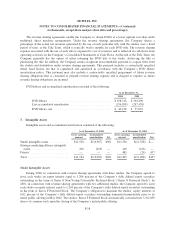

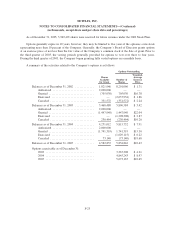

Future minimum lease payments under non-cancelable capital and operating leases as of December 31, 2005

are as follows:

Year Ending December 31,

Operating

Leases

2006 ............................................................. $ 9,555

2007 ............................................................. $ 6,299

2008 ............................................................. $ 5,279

2009 ............................................................. $ 3,736

2010 ............................................................. $ 2,740

Thereafter ........................................................ $ 5,073

Total minimum payments ............................................ $32,682

F-21