National Grid 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Going concern

Under the Listing Rules we are required to review the Directors’

statement, set out on page 54, in relation to going concern.

Wehave nothing to report having performed our review.

As noted in the Directors’ statement, the Directors have concluded

that it is appropriate to prepare the financial statements using the

going concern basis of accounting. The going concern basis

presumes that the Group and Company have adequate resources

to remain in operation, and that the Directors intend them to do so,

for at least one year from the date the financial statements were

signed. As part of our audit we have concluded that the Directors’

use of the going concern basis is appropriate.

However, because not all future events or conditions can be

predicted, these statements are not a guarantee as to the Group’s

and Company’s ability to continue as a going concern.

Other required reporting

Consistency of other information

Companies Act 2006 opinion

In our opinion, the information given in the Strategic Report and

theDirectors’ Report for the financial year for which the financial

statements are prepared is consistent with the financial statements.

ISAs (UK & Ireland) reporting

Under ISAs (UK & Ireland) we are required to report to you if,

inouropinion:

• Information in the Annual Report is:

– materially inconsistent with the information in the audited

financial statements; or

– apparently materially incorrect based on, or materially

inconsistent with, our knowledge of the Group and Company

acquired inthecourse of performing our audit; or

– otherwise misleading.

We have no exceptions to report arising from this responsibility.

• The statement given by the Directors on page 78, in accordance

with provision C.1.1 of the UK Corporate Governance Code

(the‘Code’), that they consider the Annual Report taken as

awhole to be fair, balanced and understandable and provides

the information necessary for members to assess the Group’s

performance, business model and strategy is materially

inconsistent with our knowledge of the Group acquired in the

course of performing our audit.

We have no exceptions to report arising from this responsibility.

• The section of the Annual Report on pages 51 and 52, as

required by provision C.3.8 of the Code, describing the work

ofthe AuditCommittee does not appropriately address

matterscommunicated by us to the Audit Committee.

We have no exceptions to report arising from this responsibility.

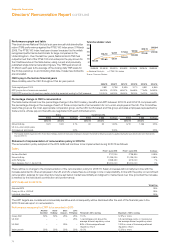

For US utility revenues billed to end consumers, we selected

samples of rate classes to test that customer rates were properly

updated in the billing systems, and that rate types were assigned

tocustomers consistent with the type of customer and (where

appropriate) the volume of usage. We also selected samples of

customer bills and tested that such bills were paid by customers

and were consistent with the regulator-approved rate plans.

Forthose bills selected that were outstanding at the end of the

year, we confirmed the balance with customers, and tested

amounts to subsequent cash receipts where no customer

confirmation was received.

In respect of unbilled revenue we tested management’s

assumptions in relation to consumption by reference to historical

data as well as specific current year factors, including weather

patterns. In so doing, we did not note any material issues.

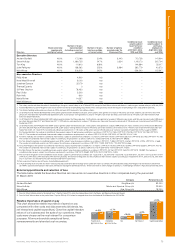

How we tailored the audit scope

We tailored the scope of our audit to ensure that we performed

enough work to be able to give an opinion on the financial

statements as a whole, taking into account the geographic

structure of the Group, the accounting processes and controls,

andthe industry in which the Group operates.

We identified that UK Electricity Transmission, UK Gas

Transmission, UK Gas Distribution and the US Regulated business

required an audit of their complete financial information due to

theirsize. As the Group has separate finance functions for head

office, the UK and US operations which each maintain their own

accounting records and controls and report to Group through an

integrated consolidation system, we used component auditors

within PwC UK and PwC US who are familiar with the local laws

and regulations to perform this audit work.

Where the work was performed by component auditors, we

determined the level of involvement we needed to have in the audit

work at those locations to be able to conclude whether sufficient

appropriate audit evidence had been obtained as a basis for our

opinion on the Group financial statements as a whole. In performing

this assessment, and in particular given the US issues in our areas

of focus, the Group team visited the US on a number ofoccasions

for meetings with our US team and the US Regulated business.

This was supported by regular conference calls throughout the

year. We also held regular calls and meetings with our UK

component teams.

The Group consolidation, financial statement disclosures and

taxand treasury related activities are audited by the Group team

using specialists where appropriate. Taken together, the territories

and functions where we performed our audit work accounted for

96% of Group revenues and 88% of Group profit before tax.

TheGroup team retains overall responsibility for the audit of the

financial statements.

Financial Statements

NATIONAL GRID ANNUAL REPORT AND ACCOUNTS 2014/15 83