National Grid 2015 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2015 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

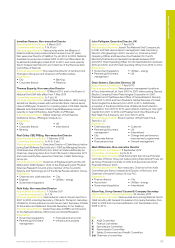

Additional Information

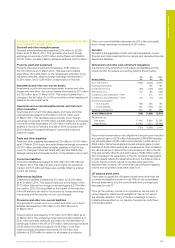

Reconciliation of adjusted operating profit to

adjusted earnings and earnings

Adjusted earnings is presented in note 7 to the consolidated

financial statements on page111.

Year ended 31 March

2015

£m

2014

£m

2013

£m

Adjusted operating profit 3,863 3,664 3,639

Adjusted net finance costs (1,033) (1,108) (1,124)

Share of post-tax results of joint ventures

andassociates 46 28 18

Adjusted profit before tax 2,876 2,584 2,533

Adjusted tax (695) (581) (619)

Adjusted profit after tax 2 ,181 2,003 1,914

Attributable to non-controlling interests 812 (1)

Adjusted earnings 2,189 2,015 1,913

Exceptional items after tax (97) 388 75

Remeasurements after tax (73) 73 156

Stranded cost recoveries after tax –– 9

Earnings 2,019 2,476 2,15 3

Reconciliation of adjusted EPS to EPS

Adjusted EPS is presented in note 7 to the consolidated financial

statements.

Year ended 31 March

2015

pence

2014

pence

2013

pence

Adjusted EPS 58 .1 53.5 50.9

Exceptional items after tax (2.6) 10.3 2.0

Remeasurements after tax (1.9) 1.9 4.1

Stranded cost recoveries after tax ––0.2

EPS 53.6 65.7 57. 2

Reconciliation of adjusted operating profit excluding

timing differences and major storms to total

operating profit

Adjusted operating profit excluding timing differences and major

storms is discussed on page 23.

Year ended 31 March

2015

£m

2014

£m

2013

£m

Adjusted operating profit excluding timing

differences and major storms 3,927 3,706 3,759

Major storms ––(136)

Adjusted operating profit excluding timing

differences 3,927 3,706 3,623

Timing differences (64) (42) 16

Adjusted operating profit 3,863 3,664 3,639

Exceptional items, remeasurements and

stranded cost recoveries (83) 71 110

Total operating profit 3,780 3,735 3,749

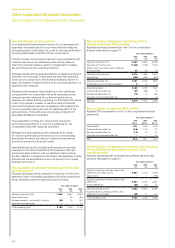

Use of adjusted profit measures

In considering the financial performance of our businesses and

segments, we analyse each of our primary financial measures

ofoperating profit, profit before tax, profit for the year attributable

toequity shareholders and EPS into two components.

The first of these components is referred to as an adjusted profit

measure, also known as a business performance measure.

Thisisthe principal measure used by management to assess

theperformance of the underlying business.

Adjusted results exclude exceptional items, remeasurements and

stranded cost recoveries. These items are reported collectively

asthe second component of the financial measures. Note 4 on

page 103 explains in detail the items which are excluded from our

adjusted profit measures.

Adjusted profit measures have limitations in their usefulness

compared with the comparable total profit measures as they

exclude important elements of our financial performance.

However,we believe that by presenting our financial performance

in two components it is easier to read and interpret financial

performance between periods, as adjusted profit measures are

more comparable having removed the distorting effect of the

excluded items. Those items are more clearly understood if

separately identified and analysed.

The presentation of these two components of financial

performance is additional to, and not a substitute for, the

comparable total profit measures presented.

Management uses adjusted profit measures as the basis

formonitoring financial performance and in communicating

financial performance to investors in external presentations

andannouncements of financial results.

Internal financial reports, budgets and forecasts are primarily

prepared on the basis of adjusted profit measures, although

planned exceptional items, such as significant restructurings,

arealso reflected in budgets and forecasts. We separately monitor

and disclose the excluded items as a component of our overall

financial performance.

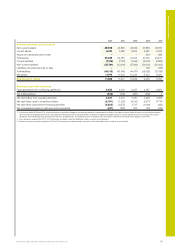

Reconciliation of adjusted operating profit to total

operating profit

Adjusted operating profit is presented on the face of the income

statement under the heading operating profit before exceptional

items, remeasurements and stranded cost recoveries.

Year ended 31 March

2015

£m

2014

£m

2013

£m

Adjusted operating profit 3,863 3,664 3,639

Exceptional items –55 (84)

Remeasurements – commodity contracts (83) 16 180

Stranded cost recoveries ––14

Total operating profit 3,780 3,735 3,749

Other unaudited financial information

Reconciliations of adjusted profit measures

186